Bitcoin Price Caught Between Record M2 Supply and Technical Resistance at $106K

- The U.S. M2 money supply topped out at $21.86 trillion, further bolstering Bitcoin’s appeal as an inflation hedge.

- Bitcoin was rejected at $106k and could fall to $100k or even below to fill in as the consolidation continues.

- The exchange’s reserves are dropping quickly, though CME exposure is still low, and SSR keeps increasing.

U.S. M2 money supply has broken out to all-time highs of $21.86 trillion, leading to calls for higher inflation and reaffirming Bitcoin’s status as a hedge against fiat debasement. The adoption of Bitcoin as a store of value has also been assisted by the sharp rise in dollars in circulation, which relates to Bitcoin’s long-term value proposition by acting as a protection against future monetary dilution.

Bitcoin is now trading above $105,600 but failed to hold above $106,000. Even though the macro backdrop remains bullish, short-term signals are getting bearish. Michael van de Poppe and CrypNuevo pointed to a rejection at $106k, with potential downside targets at $100k and the 150-day exponential moving average. However, if prices fall below the $100K level, AlphaBTC said prices could drop as low as $90,000.

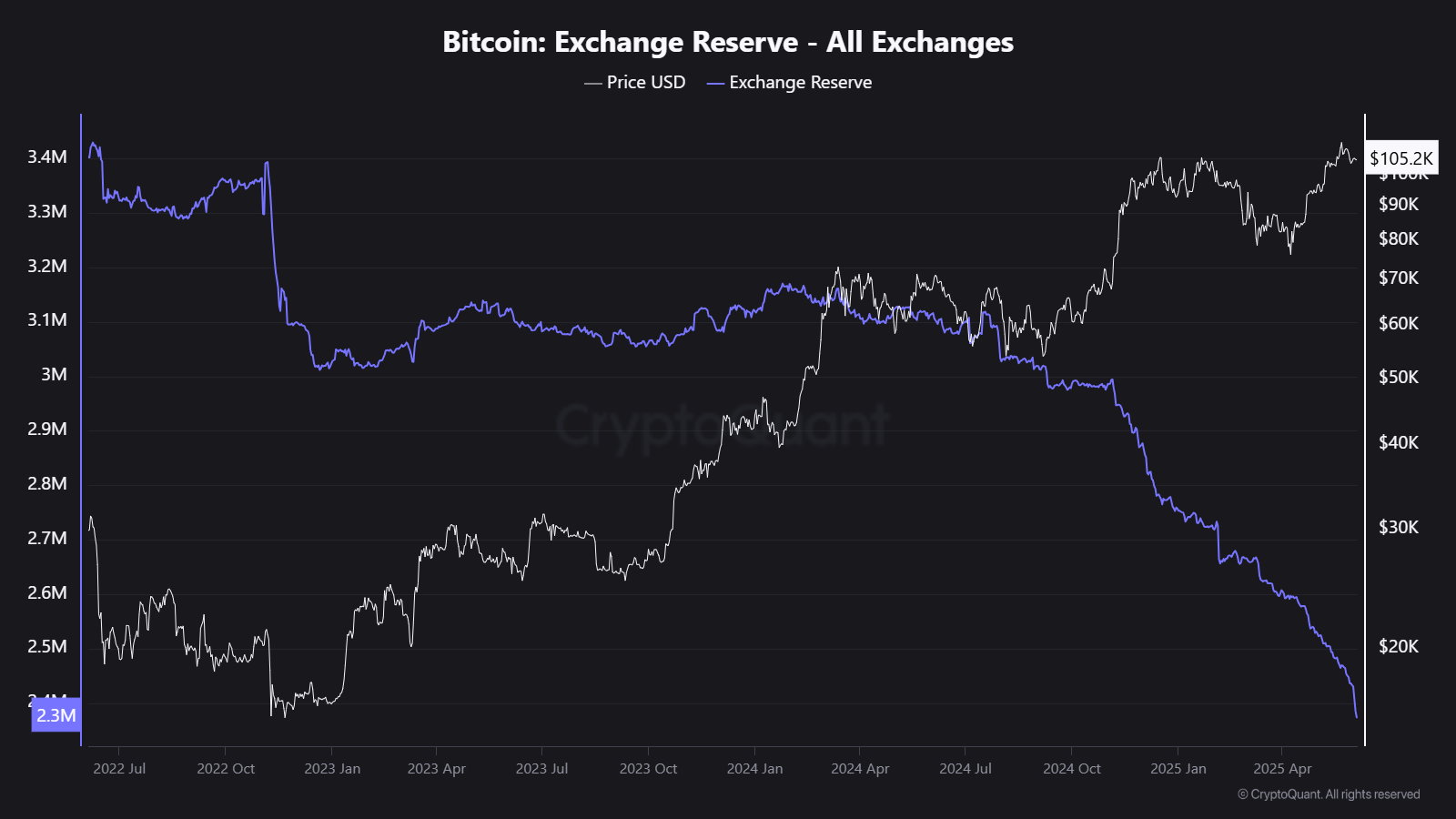

Exchange Reserves Collapse as Market Faces Liquidity Tension

Bitcoin exchange reserves sink from over 3.4 million BTC in mid-2022 to 2.3 million by June 2025, onchain data from CryptoQuant shows. Centralized platforms’ steady outflow indicates that investors are more inclined towards longer-term holding , thereby removing a source of potential selling pressure and decreasing balance sheet supply.

However, the Stablecoin Supply Ratio (SSR) has risen to 17.6. This implies a reduction in stablecoin liquidity relative to Bitcoin’s market cap, which would cap any upside from buying on the spot. Accumulation is high, while fresh capital inflows may slow, contributing to sideways price action.

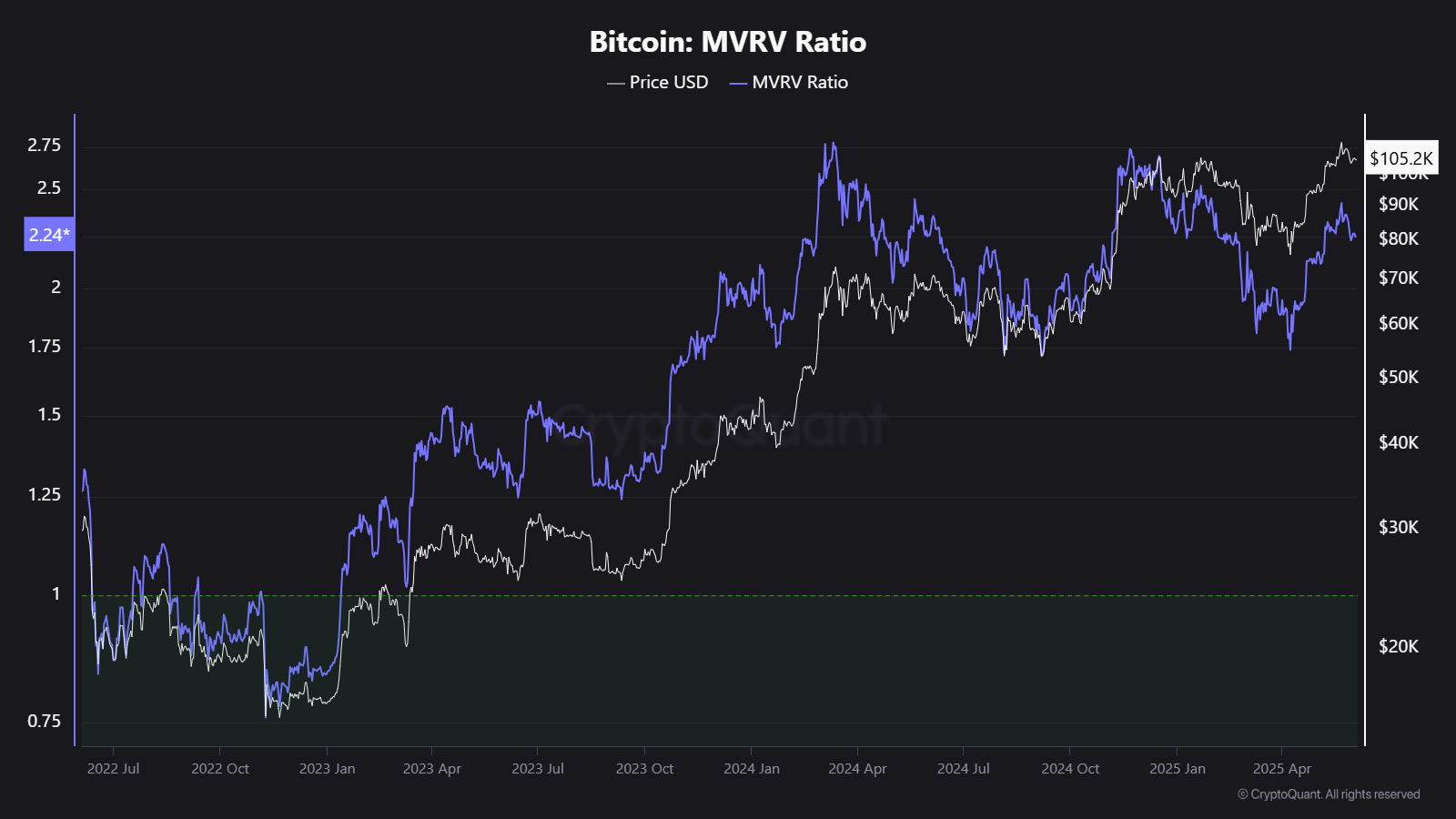

Strong unrealized profit stacking behavior among holders is shown by the MVRV ratio rising to 2.24. Such levels historically have preceded short-term corrections. While not yet at overheated peaks seen in past bull cycles, the metric advises caution for new buyers investigating today’s price levels.

CME Data, Offshore Derivatives Paint a Split Market Picture

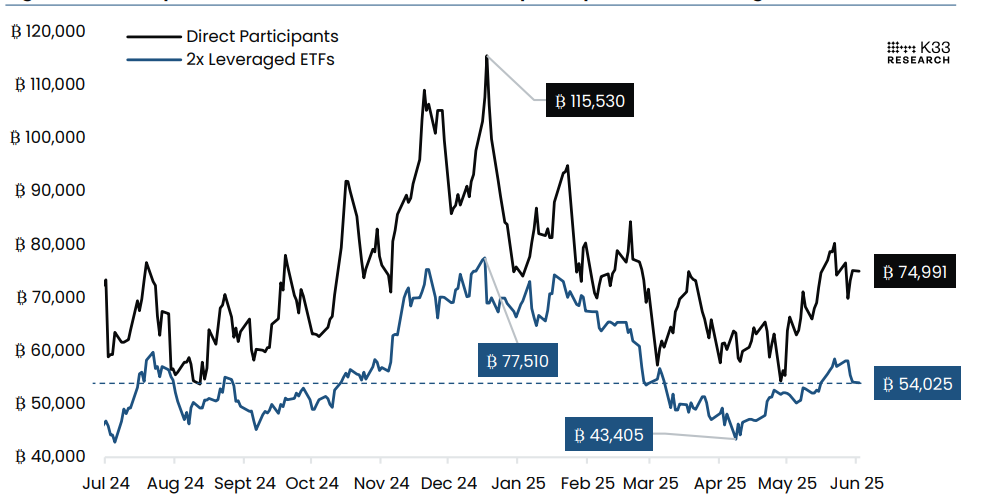

However, Bitcoin’s exposure on the Chicago Mercantile Exchange (CME) has arisen slightly but remains far below old highs. According to K33 Research, institutional players are restrained, and leveraged ETF exposure has been down over 23,000 BTC since the December peaks. Additionally, direct participant engagement lags behind earlier highs, showing participant preference to watch and wait for the June 18 FOMC meeting.

On the other hand, offshore derivatives are booming in trading. Bitcoin perpetual contract open interest has returned to late 2023 levels. However, the lack of a clear direction of the funding rate reveals that indecision abounds. Such a disposition of the market risks creating volatile liquidations as traders are also on both sides of the market.

Technical indicators are equally neutral. The MACD shows flattening momentum while RSI is near 60 indicating not overbought conditions. BTC is expected to consolidate further without a breakout, without stronger macro or on-chain confirmation.

Bitcoin Drops Below $101K Amid Liquidation of $1B in $BTC Longs as Musk-Trump Clash Rises

Bitcoin ($BTC) dips below $101K as $1B in long positions liquidate amid rising political tensions be...

Altcoin Momentum Builds as Bitcoin Dominance Stalls — Nexchain Hits $3.8M in Big Presale

Bitcoin dominance stalls while altcoin momentum builds—Nexchain hits $3.8M in presale, offering 455%...

Is This the Next 1000x Meme Coin? Punisher Coin ($PUN) Presale Rockets Past $140K

Explore Punisher Coin's presale success and why it's the top meme coin to invest in. Plus, updates o...

THE U.S. M2 SUPPLY HAS HIT A RECORD HIGH OF $21.86 TRILLION

THE U.S. M2 SUPPLY HAS HIT A RECORD HIGH OF $21.86 TRILLION