First-Mover Advantage Fades as Corporate Crypto Goes Crowded

The adoption of cryptocurrencies, especially Bitcoin (BTC), Ethereum (ETH) and Solana (SOL), as treasury reserve assets by corporations has surfaced as a significant financial strategy in recent years, with the momentum picking up more strongly in 2025.

This trend has gained momentum, propelled by objectives such as inflation protection, portfolio diversification, and the need for brand distinction, even in the face of regulatory hurdles and market fluctuations.

Worldwide, more than 90 publicly traded companies have Bitcoin assets recorded on their balance sheets, with the United States at the forefront of corporate and government adoption, according to Bitcoin Treasuries.

The stock performance of companies holding crypto reserves presents a varied landscape.

The influence of the crypto treasury reserve strategy on stock prices is subject to fluctuations, shaped by the dynamics of the crypto market as well as overarching business considerations.

The fluctuations in Bitcoin's value, the uncertainties surrounding regulations, and the demand for secure custody solutions present significant challenges.

In light of these developments, the increasing embrace of Bitcoin within conventional finance, highlighted by support from financial institutions and governmental bodies, indicates a market that is evolving and maturing.

BTC's impressive results over the last decade demonstrate the potential for substantial long-term financial gains in times of elevated inflation.

Just like many other public firms, energy infrastructure firm SolarBank intends to integrate Bitcoin into its balance sheet.

Bitcoin is the oldest cryptocurrency in circulation.

Investor confidence has been boosted by regulatory achievements, including as the US Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF in January 2024 and pro-crypto efforts from the Trump administration.

Crypto.com has formed a partnership with Trump Media & Technology Group (TMTG) and Yorkville America to introduce TMTG-branded exchange-traded funds (ETFs). By establishing itself as the technological and custodial foundation for prominent ETF launches, the cryptocurrency exchange is strategically addressing the increasing appetite from state and sovereign funds for secure, regulated, and scalable exposure to cryptocurrency.

And while the growth of Bitcoin treasuries is impressive, there is a significant risk of decline as they expand.

It appears that a significant portion of the 61 publicly traded companies that have adopted Michael Saylor's stockpiling approach have acquired Bitcoin at price points exceeding $90,000.

Approximately 50% of Bitcoin treasuries set up by non-crypto firms will need to sell off their holdings if Bitcoin drops below $90,000, according to insights from a Standard Chartered expert in a recent report to clients, Coindesk reported .

Standard Chartered's global head of digital assets research, Geoffrey Kendrick, indicated that those following Michael Saylor's Strategy (Nasdaq: MSTR) had increased their Bitcoin holdings to nearly 100,000 BTC over the last two months, resulting in an average cost per Bitcoin significantly higher than that of the Strategy itself.

Standard Chartered projects that a bitcoin price "22% below average purchase prices may result in liquidations."

Ether & Solana Not Far Behind

Still, the new adoption trend represents a strategy being implemented across major tokens.

Ethereum's first treasury company is delivering substantial dividends.

SharpLink Gaming, an online casino company, has seen its shares soar by an impressive 2,700% last week, following the successful raising of a $435 million Ethereum treasury .

The market capitalization has increased by a factor of eleven. This achievement is remarkable considering that the team only consists of five full-time staff members.

The performance is likely to enhance Joe Lubin's reputation as a strategist in managing Ethereum assets. The leader of Consensys spearheaded the fundraising initiative that facilitated the treasury transition, and he has recently taken on the role of chairman at SharpLink.

The agreement marks a significant milestone, as an established figure in the Ethereum space has adopted Saylor's approach at MicroStrategy, now rebranded as Strategy.

For years, Ethereum has been in the shadow of Bitcoin regarding discussions on institutional adoption. However, this agreement — and the surprising response from the market — may indicate a change in direction.

This week, several newly launched Bitcoin treasury companies experienced a notable decline in their stock prices, highlighting a significant trend in the market.

As for Solana, it too is getting in on the treasury strategy game. This week, Classover secured more funding for Solana acquisition . The Nasdaq-listed educational technology business with the ticker KIDZ announced a partnership with Solana Growth Ventures to issue senior convertible notes with a maximum face value of $500 million, bringing its total potential SOL-focused financing capacity to $900 million.

Classover intends to use 80% of the money to improve its Solana assets once it's finished, "subject to specific terms and limitations."

This business is the latest to join the ranks of elite enterprises using the Solana treasury strategy, which includes DeFi Development Corporation and SOL Strategies.

Recently, SOL Strategies, based in Canada, revealed that it has divested its Bitcoin (BTC) holdings to concentrate entirely on a strategy for acquiring Solana, filing a preliminary $1 billion shelf prospectus with Canadian securities regulators.

"The filing of a base shelf prospectus supports our growth strategy by providing us with the flexibility to access capital as future opportunities arise in the rapidly evolving Solana ecosystem," said CEO Leah Wald.

This action positions SOL Strategies as the second-largest corporate holder of Solana, following DeFi Development Corp , which possesses more than 600,000 SOL.

In a notable development, DeFi Development Corp introduced a liquid staking token (LST), dfdvSOL, and revealed a partnership with DeFi protocol Kamino Finance last week. Kamino is set to incorporate dfdvSOL into its borrowing and lending markets, aiming to boost its functionality and returns within the Solana ecosystem.

However, the high price at which the treasury buildup is happening in these crypto tokens is clearly a risk. The strategy that has driven spectacular returns for early adopters like Strategy could become a liability for late entrants.

For the corporate crypto treasury movement to mature successfully, late entrants will need to demonstrate the same long-term conviction and strategic patience that characterized the pioneers, rather than relying on continued price appreciation to validate their investment thesis.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Fideum's Anastasija Plotnikova on Building Regulated Crypto Infrastructure

In this episode, your host Takatoshi Shibayama sits down with Anastasia Plotnikova , CEO of Fideum , a regulated digital asset infrastructure company operating across Lithuania and Canada. They dive into what it's like to build in Europe under the new MiCA regulation, the practical challenges of regulation, and the global dichotomy between CeFi and DeFi. Anastasia shares her journey from law enforcement to crypto, and how growing up in the post-Soviet era shaped her deep appreciation for decentralized finance.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Musk vs. Trump Sparks Liquidations – Why We Believe the Correction Will Extend

Your daily access to the backroom....

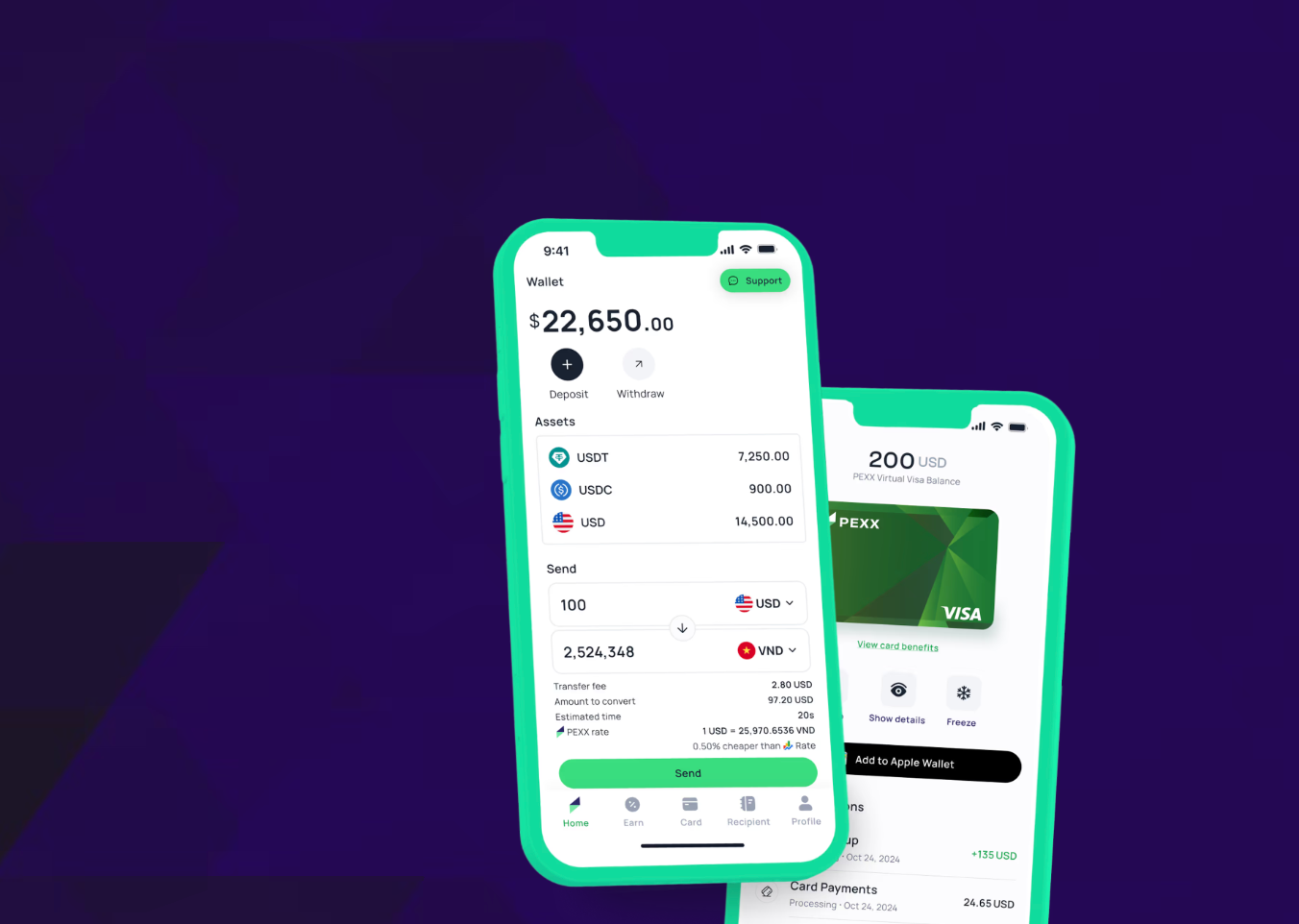

PEXX Launches Neobank, Bridging USD, Crypto for Global Users

Singapore-based fintech opens full banking suite across 50+ countries with stablecoin integration...

Circle Stock Surges 168% in Blockbuster NYSE Debut as Stablecoin Giant Goes Public

The stablecoin issuer's shares closed at $83.23, marking the crypto industry's second-largest public...