Bitcoin Trades Near $104K as Realized Price Yield Signals Cooling Profits Amid Bullish Trend

- Bitcoin trades above $104K as realized price yield shows signs of moderating profits

- Declining trading volume suggests market caution despite strong dip-buying behavior

- Divergence between spot price and profitability hints at possible consolidation phase

Bitcoin traded near $104,000 on May 14, 2025, sustaining higher price levels as on-chain metrics pointed to stable but moderating profitability. Realized price returns continue to show strength, although recent trends indicate a decline in momentum. While the spot market remains firmly in bullish territory, trading activity and yield data suggest a possible transition phase as participants assess upcoming market conditions.

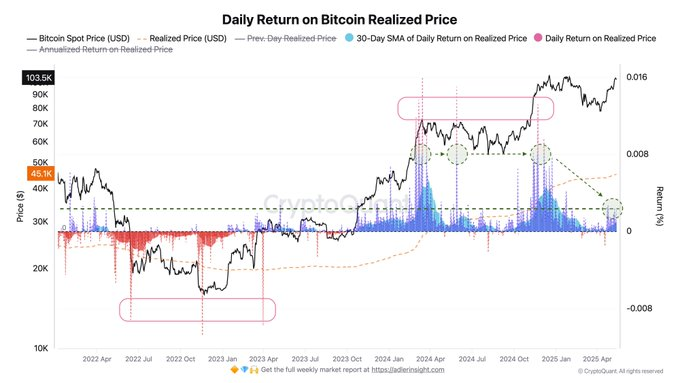

Data from April 2022 to April 2025 points out how Bitcoin ’s realized price has increased, now standing around $45,100. This metric represents the average acquisition price of all circulating BTC and is a proxy for network-wide profitability.

Daily returns on realized price have ranged between 0.10% and 0.23%, translating to annualized returns of 36% to 85%. Meanwhile, these returns’ 30-day simple moving average (SMA) is approximately 0.10%, or about 35% to 40% annualized.

Periods of extended negative returns, as seen in mid-2022 and from late 2022 into early 2023, were marked by consolidation near the $20,000 range. The realized price stagnated during those phases, and investor sentiment was muted. That trend reversed in early 2024, when consistently positive returns supported a price surge past $70,000 and toward $90,000.

Price Action Shows Strength Despite Volume Decline

As of the latest update, Bitcoin is priced at $104,081.73, reflecting a modest daily increase of 0.34%. The market capitalization has grown to $2.06 trillion, while Bitcoin’s fully diluted valuation (FDV) is $2.18 trillion. Despite these figures the 24-hour trading volume decreased by 13.29% and the number now stands at $50.26 billion. The drop in volume can be indicative of trader caution, and particularly after hitting the psychological resistance close to $105,000.

Intraday trading indicated the asset crossing over the $104,800 mark, followed by a minor correction at the opening of trading on 14th May 2022. In particular, the price dipped twice below $103,500 and rebounded immediately after. This pattern reflects the continuation of support from the dip buyers and evidence that short-term mood is upbeat.

The total supply of Bitcoin is now at 19,860,000 BTC, while the hard cap of 21 million is still in force. A volume-to-market cap ratio of 2.44% indicates a moderate liquidity level over trading venues.

Diverging Indicators Point to a Watchful Market

Even though Bitcoin’s spot price is hovering around all-time highs, a cooling of realized returns and volume implies a loss of momentum. Past patterns reveal that spurns between price and profitability measures have resulted in consolidation periods or corrections in the market.

The 30-day SMA downward move in realized price yield is a warning signal for the market players. Although the overall direction is strong, the divergence between advancing spot prices and falling returns could indicate a revaluation period before macroeconomic numbers or profit taking at resistance levels.

South Korea’s Election Sparks Momentum for Bitcoin ETF Approval

Ki Young Ju confirms South Korea’s presidential candidates support Bitcoin ETFs, raising hopes for r...

Cardano Price Prediction Holds as ADA Eyes $2 and Qubetics Surpasses $17M in Presale

Cardano price prediction strengthens with ADA nearing $1, while Qubetics gains momentum as the best ...

Hashlock Audits Cross-Chain Infrastructre and Stablecoin Interconectivty Protocol Contracts for VIA Labs

Oakland, USA, 14th May 2025, Chainwire...

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)