Solana Flips Bullish: Price Climbs Above Ichimoku Cloud With Strong Momentum

Solana (SOL) has officially broken above the Ichimoku Cloud on the daily chart, a key technical signal that often marks the beginning of a bullish trend reversal . After weeks of sideways movement and uncertainty, this decisive breakout suggests that momentum is finally shifting in favor of the bulls. While confirmation from volume and follow-through price action is still needed, the technical outlook is becoming increasingly optimistic.

Solana Ichimoku Breakout And Momentum Check

Solana’s breakout above the Ichimoku Cloud is more than just a technical checkpoint; it marks a critical shift in its market structure and trader sentiment. This breakout represents a move from uncertainty to confidence, as buyers begin to gain the upper hand after a period of consolidation and hesitation.

So far, momentum indicators are leaning bullish , providing early signs that Solana may be entering a new upward phase. One of the most notable signals comes from the Moving Average Convergence Divergence (MACD), which has recently made a positive crossover. Not only has the MACD line crossed above the signal line, but the two lines have now moved above the zero line.

This double confirmation strengthens the signal significantly. When the MACD and signal lines rise above zero, it typically marks the transition from bearish to bullish territory, indicating that momentum is not just shifting but accelerating in favor of the bulls.

However, a clear uptick in volume is essential for SOL to sustain and build on this breakout . Volume is what turns a breakout into a trend, and without it, upward momentum can quickly stall. If volume starts to pick up alongside continued price strength, it could ignite the next leg up, potentially pushing Solana toward key resistance levels.

Key Levels To Watch Now

As Solana begins to show signs of a bullish reversal, identifying and monitoring key price levels becomes essential for both short-term and long-term investors . These levels act as decision points where price action is likely to react, facing resistance or finding support.

On the upside, it can be observed that the immediate resistance of $164 has been cleared, with SOL now attempting a move toward the $211 resistance level. A clean breakout above this area, especially backed by strong volume, would open the door for a rally toward the $240 mark. Beyond that, $260 remains a major resistance to watch, marking a key round number and prior rejection area.

On the downside, $164 now serves as the nearest support following the recent breakout above the Ichimoku Cloud. Holding above this level is crucial to maintain the current bullish structure. A breakdown below it could drag Solana back to the $148–$118 support range, where buyers previously stepped in.

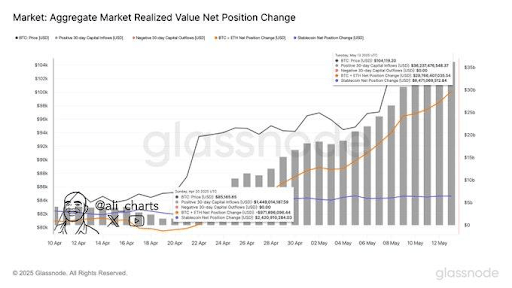

Bitcoin Bull Market: Pundit Reveals When To Sell Everything

The Bitcoin bull market looks to be back following BTC’s surge above $100,000. With market participa...

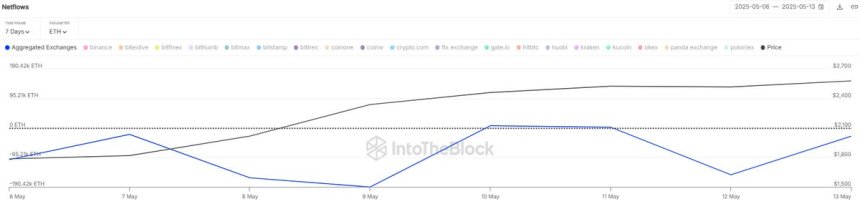

$1.2B In Ethereum Withdrawn From CEXs – Strong Accumulation Signal

Ethereum is gaining momentum again after tagging the $2,739 level and setting a new local high, reac...

XRP Price Prediction: $36 Is In The Cards As 3-Month Timeframe Turns Bullish?

Market sentiment around the XRP price is flipping bullish as technical indicators and recent chart m...