XRP Short-Term Movements Remain Uncertain, But 4-Hour Chart Shows Strength

XRP price action on lower timeframes, specifically under the 4-hour mark, remains notably uncertain, with erratic fluctuations and a lack of clear directional bias. However, a deeper analysis reveals that the broader structure on the 4-hour chart is offering more constructive insights. Despite the choppy short-term moves, the 4-hour timeframe maintains a bullish formation, suggesting that underlying momentum may be building.

The Bigger Picture For XRP

A key insight shared by market analyst Andrew Griffiths suggests that a decisive move toward the bullish order block between 2.3907 and 2.3277, coupled with strong bearish momentum, could indicate the early signs of a structural breakdown.

In his recent post on X, Griffiths emphasized that this price zone has historically acted as a significant area of demand, where buyers typically step in to defend support. However, if sellers dominate this region and the price fails to hold, it could signal a shift in market dynamics, potentially invalidating the current bullish setup .

Despite this technical vulnerability, the overall crypto market sentiment continues to lean bullish. Bitcoin’s dominance remains firm, while the TOTAL2 chart, which reflects the performance of altcoins excluding Bitcoin, maintains a bullish market structure.

These broader trends support the idea that current weakness may be a temporary shakeout rather than the start of a deeper reversal . As such, price action around the order block is key, as it could serve as a turning point in the days ahead.

Trade Setup: Waiting for Confirmation at Key Levels

Andrew Griffiths outlined a strategic trading approach centered around the 4-hour bullish order block between 2.3907 and 2.3277. According to Griffiths, a price test of this zone, if accompanied by weak bearish momentum, could present a favorable buying opportunity.

This aligns with his personal trading methodology, which focuses on identifying high-probability entries where price reacts to key levels with signs of exhaustion from the opposing side. For traders looking to capitalize on potential long setups, this zone may serve as an ideal area for entry, provided certain conditions align. Signs such as decreasing sell volume, long lower wicks (indicating rejection), or bullish candlestick formations within or just above the zone may act as confirmation of weakening bearish pressure.

Griffiths also emphasizes the importance of waiting for a clear reaction, rather than preemptively entering a position, to reduce the risk of a deeper breakdown. A well-placed stop-loss just below the lower boundary of the order block (2.3277) could offer a favorable risk-reward ratio, especially if the broader trend resumes to the upside .

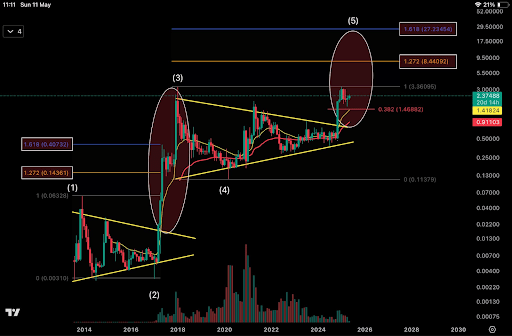

Two Major Fibonacci Levels Put XRP Price At $8.40 And $27

XRP’s price action in the past seven days has been nothing short of impressive. The cryptocurrency r...

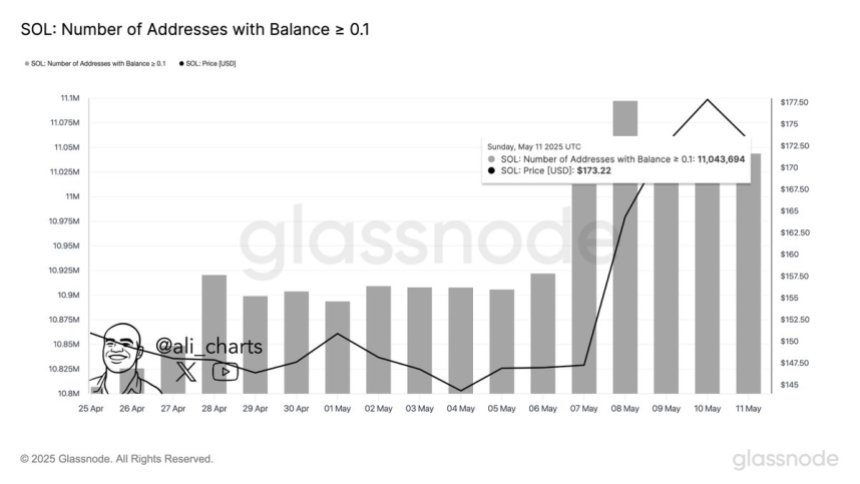

Solana Network Activity Grows As 11M Wallets Now Hold 0.1 SOL Or More – Analyst

Solana has rallied more than 22% since last Thursday, riding the wave of renewed bullish momentum ac...

Dogecoin Hits Critical Zone—Here’s What 3 Leading Analysts Are Watching

Dogecoin’s revival from the late-April trough at $0.1298 to Monday’s intraday spike at roughly $0.25...