BONK Poised For Liftoff As Bulls Target Long-Term SMA Breakout

According to crypto analyst CryptoS6, BONK is approaching a critical juncture as it tests the 200-day Simple Moving Average (SMA) at approximately $0.0000238, a level that has historically acted as a strong resistance during downtrends. A decisive break and sustained move above this long-term indicator could signal a significant trend reversal, effectively marking the end of BONK’s prolonged bearish phase. CryptoS6 emphasizes that reclaiming this level would validate bullish momentum and reestablish buyer dominance, setting the stage for an extended rally .

Breaking The Long-Term SMA: Why This Level Matters

In a recent update on X, popular crypto analyst CryptoS6 pointed out that BONK is flashing signs of a significant technical shift. The price is currently testing the 200-day SMA at $0.0000238, an area widely regarded as a major trend-defining level. Reclaiming this zone would mark BONK’s first serious bullish reversal since early Q1, signaling that buyers are regaining control after months of sideways or bearish pressure. Such a shift in control could ignite renewed investor interest and set the stage for an extended rally .

What makes the setup even more interesting is the minimal resistance standing between the current price and the 0.5 Fibonacci retracement level at $0.0000348. According to CryptoS6, this area often becomes a magnet for breakout-driven momentum, creating room for swift upward moves. If BONK can firmly close above the 200-day SMA, the probability of a stronger rally increases dramatically, as traders are likely to pile in behind the move.

CryptoS6 didn’t hold back from making a bold projection either. He suggested that BONK’s chart is setting the stage for what could be a “God Candle” explosive move, a vertical price move that would rapidly push he token from $0.000025 to $0.00004.

BONK 3-Way Confirmation: Volume, Trend & History Say ‘Go’

CryptoS6 firmly emphasized that a combination of growing volume, strong trend alignment, and striking historical pattern symmetry reinforces the case for a major breakout in BONK. The recent surge in volume is not just noise; it reflects increasing market participation and suggests that accumulation is underway, often a precursor to a significant price move. Meanwhile, BONK’s price action is aligning with key moving averages, particularly as it eyes a reclaim of the 200-day SMA, a critical indicator of long-term trend shifts.

In conclusion, CryptoS6 described the setup as “clean,” meaning the chart offers a well-defined structure and reliable levels for both entry and risk management. With momentum continuously building and minimal resistance ahead, the risk/reward profile remains highly favorable.

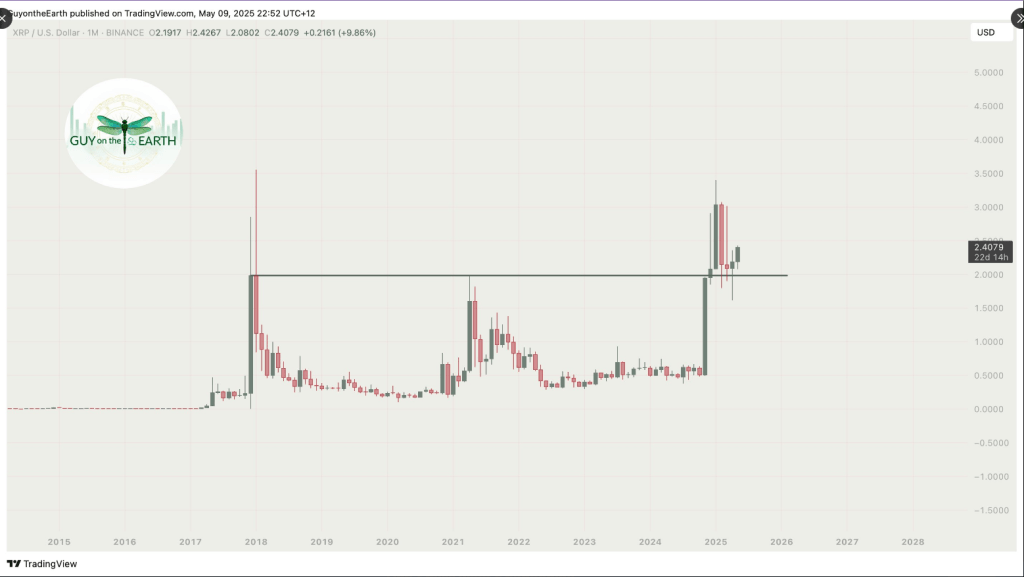

New XRP Rally Incoming? Analyst Believes This Cycle Is Unique

XRP investors are keeping an eye on a crucial price level this week. Bitcoin has managed to reclaim ...

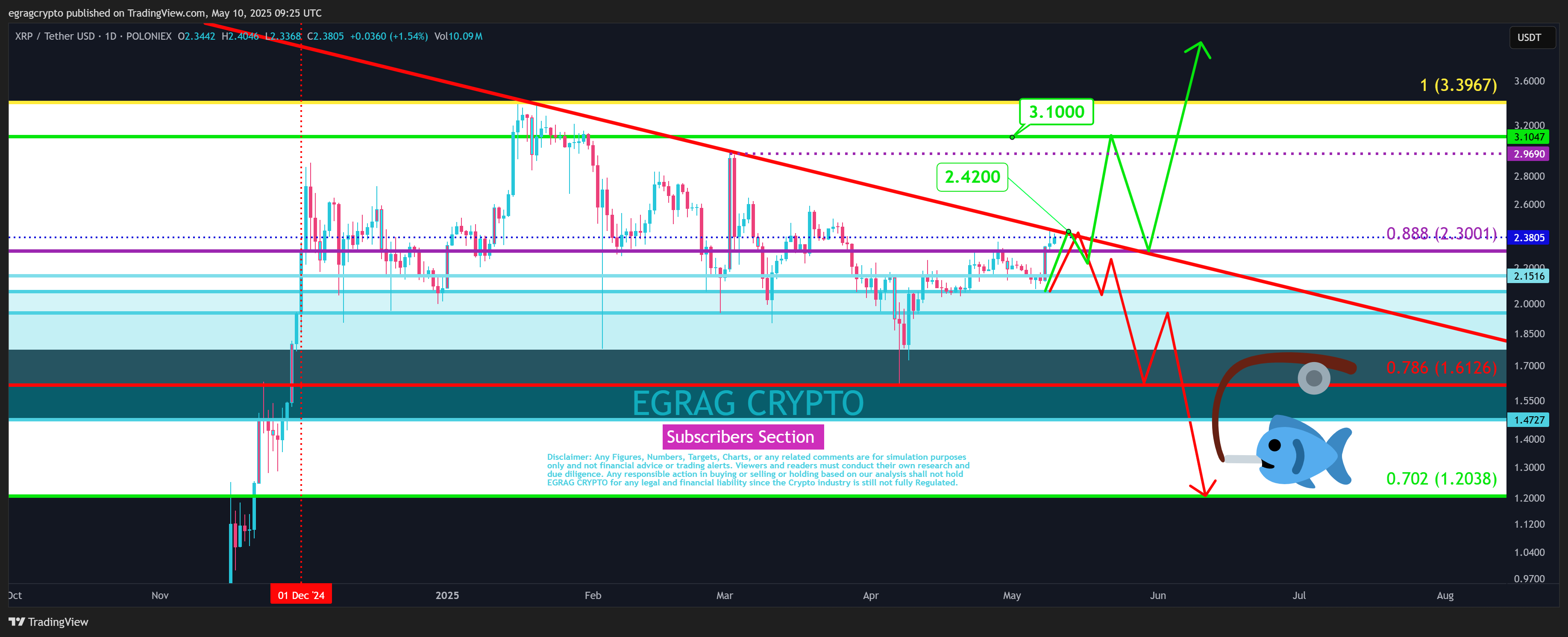

XRP Must Close Above These Price Levels To Invalidate Bearish Forecast – Analyst

XRP prices moved by almost 3% in the past day as the crypto market bounce continues. However, the pr...

XRP Flashes Death Cross From 2017 That Could Trigger 325% Rally To $9

XRP is turning heads again following an impressive show of resilience in recent days, bouncing from ...