Bernstein: Public Firms Projected to Allocate $330 Billion into Bitcoin by 2029

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Public companies could channel over $300 billion more into Bitcoin over the next five years, according to a new report by analysts at asset management firm Bernstein.

This potential inflow stems from a growing number of corporates adopting a strategy modeled after MicroStrategy's aggressive Bitcoin accumulation culture. Bernstein disclosed this projection in a recent report.

The asset manager’s base case outlines that between 2025 and 2030, listed corporations could direct nearly $205 billion into

Bitcoin

. An additional $124 billion is expected to come from companies replicating the capital deployment plan of Strategy (formerly Microstrategy).

Currently, Strategy holds 555,450 BTC, purchased at a total cost of approximately $38.08 billion, based on an average price of $68,550 per coin. Most recently, Strategy added 1,895 BTC for $180 million.

https://twitter.com/saylor/status/1919362210804990383

These projections rely on the premise that more public companies with limited organic growth paths and large cash reserves will follow Strategy’s lead.

Screened Firms May Drive Billions in Bitcoin Demand

Bernstein

estimated

that if just 20% of these screened companies allocated 25% of their treasury reserves to Bitcoin, it could generate approximately $190 billion in inflows.

The firm noted that such companies are typically low-growth and have surplus capital without productive avenues for reinvestment. As a result, Strategy’s approach may appeal to these firms as they seek new asset strategies.

Meanwhile, the share of total Bitcoin supply held by public companies has climbed to 3.4%, up from 1.3% at the end of 2023. This increase coincides with broader regulatory and accounting shifts. Data confirms that these companies hold a total of 720,898 BTC worth $67.8 billion at press time. Meanwhile, private firms hold 398,323 BTC currently worth $37.44 billion.

Market Conditions Support Expansion

Meanwhile, the Bernstein report also pointed to Strategy’s role in building institutional-grade instruments that facilitate access to Bitcoin.

Bernstein analysts observed that Strategy’s financial structuring has allowed it to scale during multiple market cycles, although they cautioned that similar success is not guaranteed for others attempting to imitate the model.

Still, growing access to capital markets and the declining float of available Bitcoin suggest that corporate adoption could tighten supply. Strategy’s Chairman, Michael Saylor, recently reiterated his intention to continue acquiring Bitcoin, stating readiness to buy even at $1 million per coin, with potential daily purchases of $1 billion.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503937.html

Related Reading

Bitcoin Leads as Crypto Investment Products Record $2B in Net Inflows

Investment products tied to cryptocurrencies registered their third consecutive week of inflows, wit...

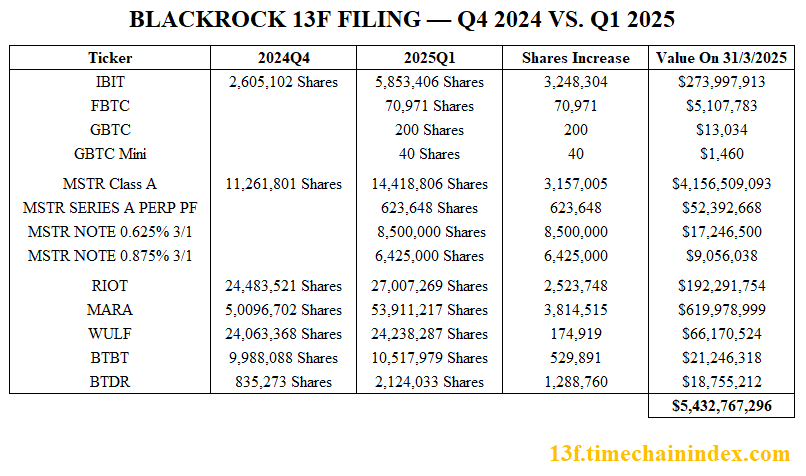

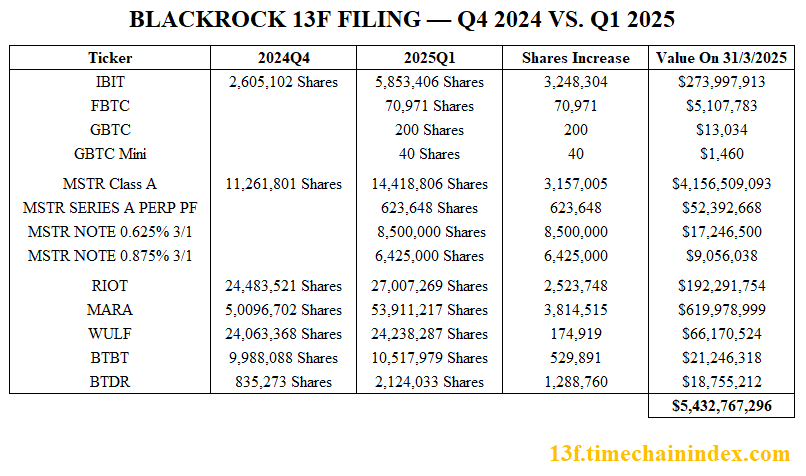

BlackRock Holds Over $5B in Bitcoin Stocks, With $4.23B in Strategy Alone, Latest Filing Shows

BlackRock's latest 13F filing for Q1 2025 reveals a significant uptick in its Bitcoin exposure. Th...

Strategy Acquires 1,895 BTC in Latest Purchase, Expands Bitcoin Holdings to Over 555,000

Strategy, formerly known as MicroStrategy, has confirmed another addition to its growing Bitcoin res...