Bitcoin’s Universal Yield Layer Capabilities are Reshaping Trust, Security, and Utility Across the DeFi Landscape

The post Bitcoin’s Universal Yield Layer Capabilities are Reshaping Trust, Security, and Utility Across the DeFi Landscape appeared first on Coinpedia Fintech News

For over a decade, Bitcoin’s mainstream use cases have largely been limited to single one-off transfers (for moving large sums) or as a store of value, especially in comparison to more programmable blockchains.

However, with the emergence of efficient liquidity mechanisms recently, it has become possible to unlock billions in value while maintaining the same ethos of security and trustlessness that have helped forge the flagship crypto’s reputation.

To elaborate, traditional methods of utilizing Bitcoin within the DeFi landscape have typically involved wrapping or creating synthetic representations of the token on other chains, thereby introducing additional layers of risk and complexity. In this context, the idea of shared liquidity fundamentally changes this status-quo by allowing holders to maintain exposure to Bitcoin’s value appreciation while simultaneously putting their assets to work in securing decentralized services.

Moreover, the concept of liquid security builds upon the proven security mechanisms of proof-of-stake (PoS) systems but applies them to Bitcoin’s massive fund pool. By enabling BTC holders to use their assets as collateral, it creates powerful economic incentives that align the interests of holders with the security needs of the broader ecosystem.

This alignment is particularly crucial for emerging protocols and services that struggle with the “ cold start ” problem – i.e., the challenge of establishing sufficient security and trust following the first few months/years of their launch. In that sense, BTC’s unmatched reputation and significant market capitalization make it the ideal security backbone for these nascent systems.

The implications of such universal yield layers on the DeFi market stand to be far-reaching as beyond simply enabling yield generation, they can create a new paradigm of trust minimization and security. To this point, when Bitcoin is used as collateral in these liquidity efficiency protocols, it introduces strong economic security guarantees for validators and service providers. Any malicious behavior can result in penalties, where the provided Bitcoin is confiscated or burned.

A few pioneers are leading the way

From the outside looking in, creating an efficient liquidity layer requires sophisticated technical infrastructure that is capable of bridging Bitcoin’s relatively limited programmability with the complex requirements of modern DeFi applications.

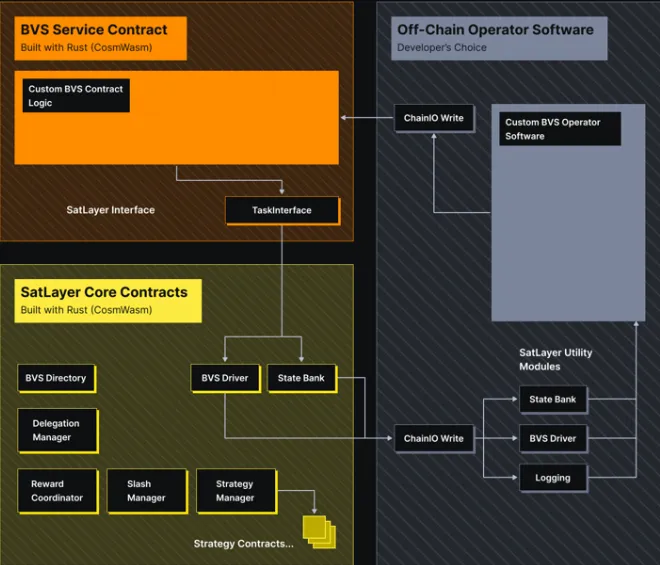

Among the platforms working to fulfill this vision, SatLayer has emerged as a standout entity. Founded in early 2024 by MIT alumni, it operates as a shared security platform specifically designed to leverage Bitcoin as its primary security collateral. By being deployed as a set of smart contracts atop the popular platform Babylon, SatLayer enables BTC holders to secure any type of decentralized application or protocol as a Bitcoin Validated Service (BVS), effectively transforming how Bitcoin’s massive value can be harnessed within Web3.

On a more technical note, one can see that SatLayer connects three critical participant groups, namely Bitcoin providers who enhance economic security by depositing their coins; BVS developers who create and maintain services secured by this Bitcoin; and Operators who provide the technical infrastructure to run these services.

This three-sided marketplace enables Bitcoin holders to earn rewards for providing security while developers can bootstrap new services with robust security guarantees. Lastly operators can receive compensation for their technical expertise and infrastructure provision.

Another truly standout aspect of SatLayer — one that differentiates it from other platforms — is its implementation of fully programmable penalty conditions . For instance, when a penalty condition is triggered within a BVS’s on-chain contract, operators who violate established rules can have their provided assets confiscated (creating strong financial incentives for responsible operation while giving BVS developers considerable flexibility in designing their security parameters).

These penalized assets can be redirected as protocol revenue or permanently burned, creating accountability within a trustless system.

Lastly, it bears mentioning that in recent months SatLayer has forged strategic partnerships with leading entities like Babylon Labs (which currently possesses over $3.5 billion in Total Value Locked (TVL). Not only that, the project’s upcoming integration with Sui — an L1 designed for near-instant and low-cost transactions — has showcased its commitment to expanding Bitcoin’s utility across multiple ecosystems.

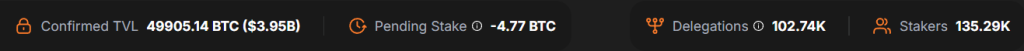

Recent metrics associated with the Babylon ecosystem (as of April 8, 2025)

A limitless future

Whether one likes it or not, SatLayer’s universal yield layer stands to represent one of the most significant evolutions for BTC and how it can interact with the broader DeFi ecosystem. As the technology continues to mature, one can expect to see increasingly sophisticated applications of Bitcoin’s security across the Web3 landscape, potentially paving the way for a more value-driven crypto ecosystem.

Robert Kiyosaki: I Don’t Trust “Fake” Dollars – I Trust Bitcoin!

The post Robert Kiyosaki: I Don’t Trust “Fake” Dollars – I Trust Bitcoin! appeared first on Coinpedi...

Top 3 Cryptos to Buy Now, Which One Has 27x Potential?

The post Top 3 Cryptos to Buy Now, Which One Has 27x Potential? appeared first on Coinpedia Fintech ...

Just In: Ripple Donates $25 Million in RLUSD to Support U.S. Classrooms and Teachers

The post Just In: Ripple Donates $25 Million in RLUSD to Support U.S. Classrooms and Teachers appear...