ALPACA Records $45.73M in Liquidations as Crypto Market Suffers $225M Shakeout

- ALPACA leads crypto liquidations with $45.73M lost, triggering major Bybit trade closure.

- Over 124K traders liquidated as $225M vanishes amid short-side market reversal.

- XRP, SUI, SOL, and others see heavy losses in broad altcoin liquidation sweep.

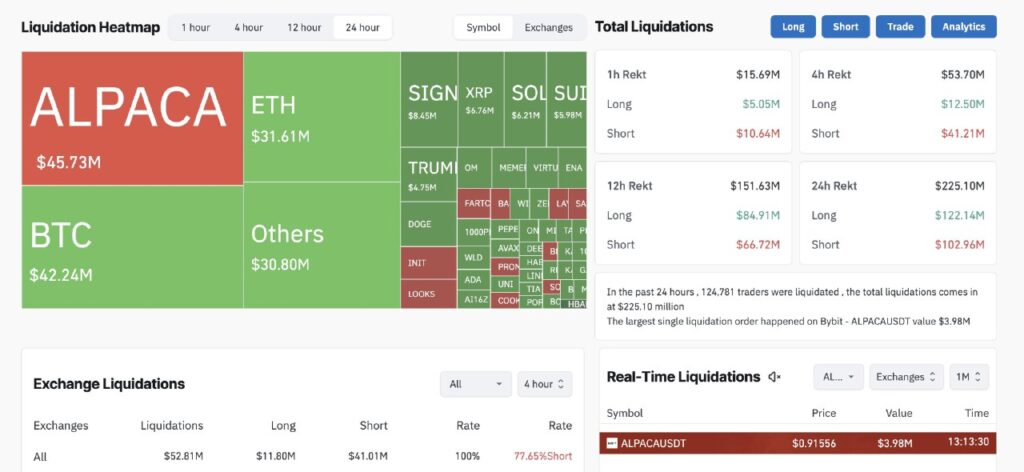

A sharp spike in market volatility led to a wave of liquidations across the crypto derivatives market, wiping out $225.10 million in trader positions over a 24-hour period. According to Lookonchain, ALPACA registered the highest liquidation losses among all assets, totaling $45.73 million. The largest individual liquidation occurred on Bybit in the ALPACAUSDT trading pair, where one position worth $3.98 million was closed.

The liquidation event impacted more than 124,000 traders globally. Long positions accounted for $122.14 million in losses, while shorts made up $102.96 million. The price of ALPACA dropped to $0.91556 during the downturn, contributing to the high volume of liquidated trades linked to the asset.

Short-term volatility intensified within a 12-hour window, as total liquidations hit $151.63 million. Within a focused 4-hour stretch, losses reached $53.70 million, with $41.21 million of that tied to short positions. Long trades during the same time amounted to $12.49 million.

Short Positions Dominate Liquidation Totals

Exchange-level data from the past four hours showed $52.81 million in liquidations. A majority, 77.65%, were short positions, while long trades made up just $11.80 million. The figures suggest bearish traders were caught off guard by a sudden price reversal, leading to forced closures at scale.

Heatmap indicators confirm that the bulk of the liquidations were on the short side. The abrupt shift in market direction triggered cascading liquidations, particularly for traders holding high-leverage short positions across several altcoins.

XRP, SUI, SIGN Among Other Impacted Tokens

ALPACA was not the only asset affected. SIGN saw $8.45 million in liquidations, XRP followed with $6.76 million, SOL registered $6.21 million, and SUI logged $5.98 million. Other tokens, including TRUMP and DOGE, also recorded liquidation activity, adding to the broad-based market losses.

The deterioration in large and small tokens indicates that the market is vulnerable to leveraged trading and higher price fluctuations. Experts remain vigilant as they observe the further effects of fluctuations in prices in an attempt to find their level.

The occasion has brought attention to risk management, particularly to derivative cryptocurrencies. Since most of the forced liquidations are due to margin calls, the information presents persistent risks related to market fluctuations.

ICP and TON Dominate April Blockchain Speed Rankings with Highest TPS

ICP and TON led April 2025 blockchain rankings with top TPS scores, outpacing Solana, Ethereum, and ...

Roswell Launches Bitcoin Emergency Fund for Public Aid

Roswell launches a Bitcoin emergency fund with a $2,906 donation as major central banks like Switzer...

REI Network to Expedite Web3 Innovation in Collaboration with Jumbo Blockchain

The partnership between REI Network and Jumbo Blockchain attempts to leverage the strengths of both ...