M2 Money and the Rise of Digital Finance

In the rapidly evolving financial industry, including cryptocurrencies and digital assets, knowing about the key indicators can be quite beneficial for investors. One such metric is M2, which gauges the money supply while indicating the near-cash and cash flows in the economy. At present, while the world is becoming more and more influenced by the leading crypto assets such as Bitcoin ($BTC) , Ethereum ($ETH) , and stablecoins, understanding M2 has become more crucial than ever.

M2 (Money Supply): An Introduction

Based on its nature, M2 provides an overview of the cumulative money that exists in economic sectors like crypto market. Moving beyond just physical cash, M2 also takes into account checking accounts, certificates of deposits lower than $100,000, money market mutual funds, and savings accounts.

In general, M2 serves as the soul of the economic activity and notifies about the total availability of the resources for user spending, new investors, or business investment. The growth in M2 often highlights an expansion phase as more cash signifies more borrowing, spending, and often more increase in asset prices. On the other hand, the stagnant or shrunk M2 may indicate an approaching recession or at least a wider economic slowdown.

The United States Federal Reserve comprehensively tracks the M2 components. They take into account checking deposits and cash, money market funds, small-time deposits, and savings accounts. In particular, checking deposits and cash (also termed M1) denote the rapidly available M2 component. This includes checking account funds, bills, and coins. Apart from that, savings accounts are relatively less liquid by the users can easily access them. They often provide minor interest returns while staying available when needed.

Additionally, money market funds offer short-term investment opportunities with better yields in comparison with savings accounts. Along with that, small time deposits are fixed-term deposits, requiring the users to lock money for a certain period for increased interest rates. Cumulatively, these M2 elements develop a robust overview of how much funding can precisely be mobilized in a provisional period. Hence, this presents a crucial insight to facilitate those tracking the broader economic momentum.

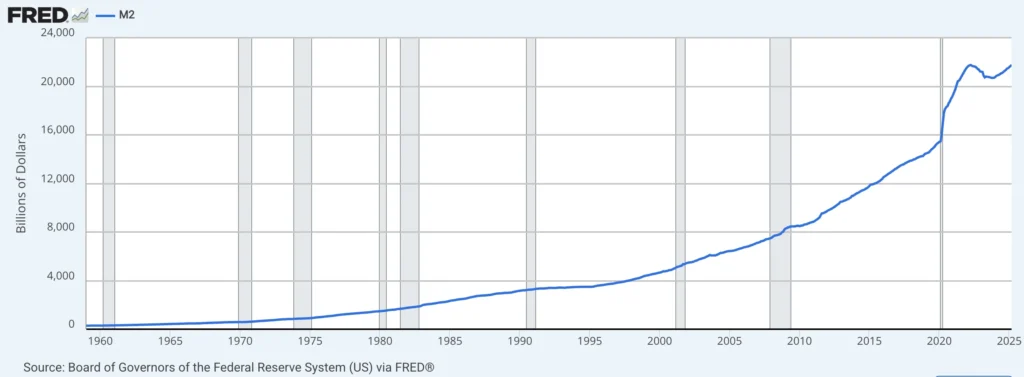

Based on the historical data, M2 changes have been closely related to the shifts in the conventional financial markets, such as bonds and stocks. Nonetheless, throughout the past decade, crypto assets have revolutionized the financial sphere as an exclusive asset class that is impacted by wider monetary trends.

Relationship of Crypto with M2

During the M2 expansion, specifically in a setting marked by decreased interest rates, people normally seek opportunities for higher returns. Conventional bonds and savings accounts deliver meager yields, forcing investors to seek riskier assets. This serves as the key reason behind the massive surge of Bitcoin ($BTC) and the rest of the well-known crypto assets amid staggering M2 growth periods.

For instance, in the COVID-19 pandemic period, ultra-low rates and huge stimulus efforts pushed toward a large-scale liquidity explosion. Hence, the crypto markets were stormed by massive inflows, resulting in the 2021-2022 bull market. Notably, Bitcoin jumped from below $10,000 to more than $60,000, whereas altcoins, including Solana ($SOL) and Ethereum ($ETH), also reported noteworthy profits.

Contrarily, amid the M2 contraction, often during the time when the Federal Reserve implements hard monetary policy, a liquidity dry-up season is witnessed. Additionally, borrowing becomes relatively expensive, and savings seem more attractive amid the diminishing risk appetite.

Factors that Drive M2 Changes

There are many forces that impact M2 shrinks or grows as follows:

- Government Expenditure

This includes stimulus payments, heightened government investment, and tax refunds that inject capital into the financial market to broaden M2. On the other hand, increased taxes or spending cuts can decrease it.

- Central Bank Policy

In this respect, the Federal Reserve plays a key role. It adjusts reserve requirements and interest rates to either discourage or encourage lending. Higher rates tend to slow down M2 while lower rates boost it.

- Business and Consumer Sentiment

When companies and individuals feel optimism, they invest more, raising M2 velocity. As opposed to this, cautious or fearful behavior can pause growth.

- Bank Lending Approach

M2 can also bloom at the time when banks show eagerness to lend, implementing easy terms with low rates. Nevertheless, if banking institutions tighten their lending terms, money generation slows down.

M2’s Relationship with Inflation

Amid the availability of more funds indicates more willingness among the businesses and people for more expenditure. Hence, if the respective spending increases rapider than the economy’s capability to produce services and goods, prices may increase, resulting in inflation.

Conversely, if M2 stagnates or shrinks, inflation may become passive or slow. However, too much shrinking of M2 could also signify the slowed economy and even lead to a recession.

Conclusion

Keeping in view the notable role of M2 in measuring the overall market behavior, it goes beyond just a number. It displays how much capital is exiting in the system and is ready to be utilized. It takes into account the everyday money such as checking accounts and cash, along with CDs and other savings. Thus, keeping track of M2 assists in comprehending the direction of the economic landscape, especially in the extremely volatile crypto sector.

Tether Mints Additional 1 Billion USDT On Tron, Hits $71B In Total Supply

With this new $USDT minting, Tether has achieved a massive milestone by hitting the staggering figur...

Ice Open Network and Mises Browser Team Up to Boost Mobile Web3 Access

Ice Open Network has partnered with Mises, which is the world's first mobile Web3 browser engineered...

Top Crypto and Blockchain Events of This Week: 28th April to 2nd May

Whether you are a crypto enthusiast, blockchain developer, or an investor, attending these events ca...