Altcoin Season Hype Grows as Bitcoin Surges Above $88K and Liquidity Returns

- Bitcoin jumped above $88,500, but U.S. stocks fell, and gold also set fresh record highs.

- Altcoins could rise shortly as the market cap has a bullish triple bottom and stablecoin activity rises.

- Some analysts hold this view since Bitcoin dominance is rising while most alts lag.

Bitcoin has risen past $93,000, touching its highest in the market since late March. The news comes when U.S. equities are being pushed lower, and gold retreats from an all-time high. Analysts now have turned to anticipating that the altcoin could be on the verge of rallying.

Analyst Michaël van de Poppe highlighted that Bitcoin is still ranging and gathering steam while the Ethereum ecosystem contracts continue to rally. Ethereum has seen only a small uptick in price while the DeFı and Layer 2 space has outperformed.

Another analyst, Miles Deutscher, identified two signs that fueled optimism about altcoin. The first of these is the decoupling of Bitcoin from other markets, such as equity markets. While the S&P 500 weakened amidst macros and trade war effects, Bitcoin soared more than 3% on Monday and was over it. The second is a bullish triple bottom pattern in the altcoin market cap view, which is a typical reversal pattern.

However, at the same time, Bitcoin is actively regaining an association with gold, which peaked at $3,500 and is now trading at nearly $3,455. In the past, gold appeared to have played a leading role in signaling an uptrend in BTC, mainly as a safe-haven asset.

Rising Inflows and Stablecoin Growth Signal Fresh Liquidity

The U.S. spot Bitcoin ETFs also revealed institutional buyers’ interest and witnessed their highest daily inflows after 90 days. The flows seem to be linked to expectations around Federal Reserve policy, with Donald Trump reportedly eyeing to sack Jerome Powell.

The crypto market is also growing in terms of liquidity. Tether stablecoin’s market capitalization has risen by 26% in eight months, while the USDC has risen by nearly 93%. Many analysts see this rise in stablecoin supply as a bullish narrative, which signals that capital is up for the task of funding higher-risk altcoins.

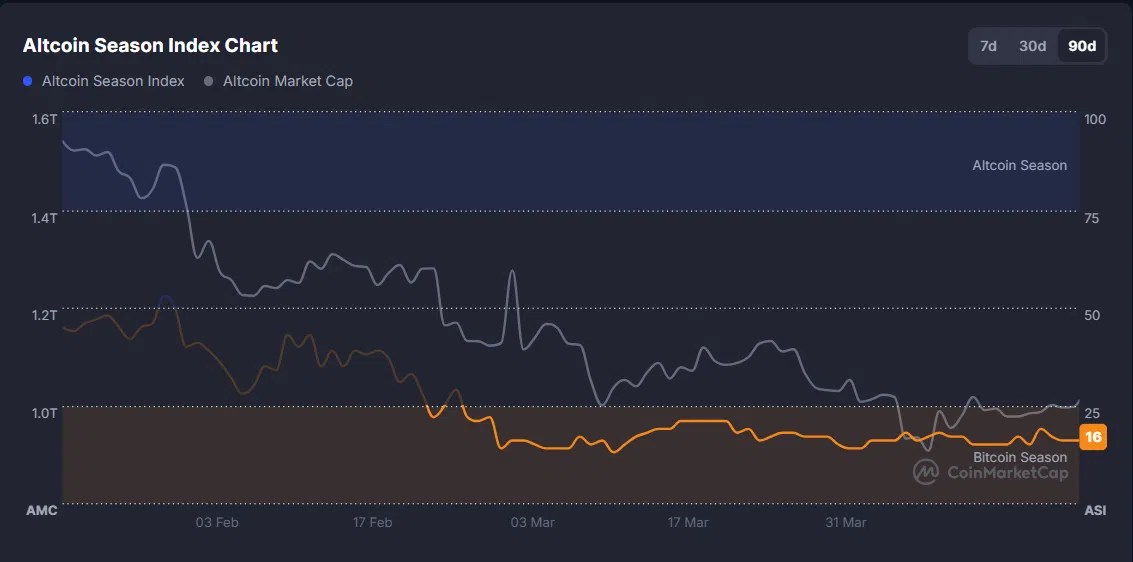

Still, doubts remain. According to Matrixport analysts, Ethereum’s dominance is falling once again, thus undermining the season of altcoins. Moreover, the CoinMarketCap of the altcoin season currently stands at 16, which is significantly lower than the 75, which is indicative of an altcoin season.

Bitcoin Still Dominates as Altcoins Struggle to Hold Value

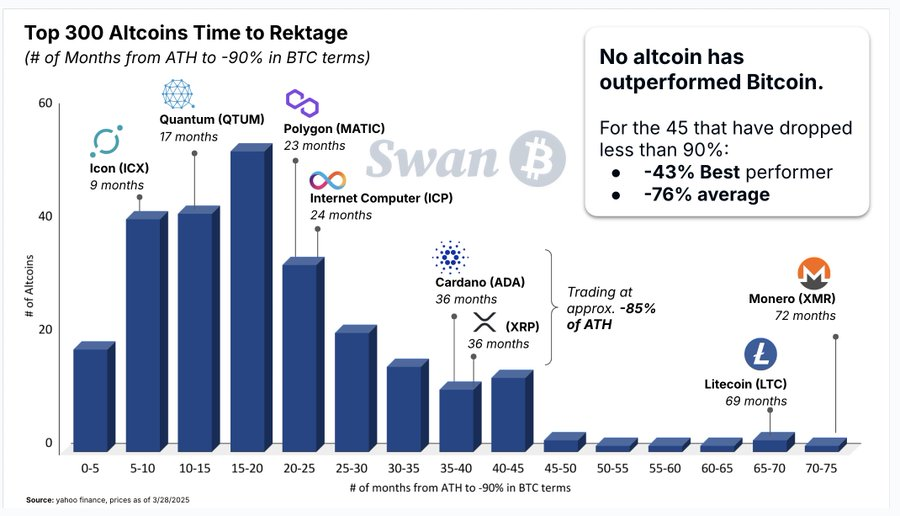

A recently released report by Swan, the Bitcoin-only financial firm, notes that people should not expect altcoins to replicate prior trends. Its study revealed that the majority of the altcoins in the market have always been below 90% in value of the leading coin, Bitcoin, within the next 10 to 20 months of their peak.

His analysis establishes Bitcoin remains the dominant store of value in the crypto market. This has increased from the previous 40% in November 2022, paving the way for more capital to go to Bitcoin than to altcoins.

Some analysts are wondering whether cycles of altcoins will remain in future cycles at all. With growing institutional demand for BTC and better regulatory frameworks being adopted globally, the landscape may have changed permanently to BTC-focused investment flows.

Flux and CryptoAutos Partner to Boost Car Sales and Rentals With $FLUX

Recently, the decentralized cloud platform Flux has joined forces with CryptoAutos to provide blockc...

Competitive Buying Structure Drives BlockDAG’s Rise to 170K+ Holders as ICP Sees a Bounce & UNI Faces Whale Pressure

Discover how BlockDAG’s Buyer Battles are shaking up presales, building a 170K+ strong community. Ex...

UniLend Finance and ColdStack to Redefine Web3 Landscape Together

The collaboration denotes a key move toward establishing relatively interoperable and robust decentr...