American Entrepreneur Predicts How High XRP Can Reach if XRP Replaces SWIFT

Favorite

Share

Scan with WeChat

Share with Friends or Moments

An American businessman has called attention to some audacious XRP price predictions, citing the asset's potential to complement or replace SWIFT.

American entrepreneur and financial commentator Patrick Bet-David brought new attention to XRP's long-debated potential to transform global finance.

XRP Potential to Complement or Replace SWIFT

Speaking on an

episode

of his widely followed TV program

Valuetainment

in March, Bet-David highlighted the possibility of XRP overtaking the SWIFT network or handling a portion of its value, a development that could massively increase the crypto asset's value.

Bet-David pointed out that for individuals not deeply immersed in crypto assets, XRP is still something worth keeping an eye on due to its unique capabilities. He mentioned a hypothetical scenario where the XRPL native token fully replaces the SWIFT financial messaging system and potentially FedNow.

According to Bet-David, the XRPL, with its ability to settle transactions in three to five seconds at a fraction of a cent, is far superior in speed and cost-efficiency

compared to SWIFT

, which processes around $5 trillion daily or approximately $1.25 quadrillion annually.

Bet-David Spotlights XRP to $1,000 Forecast

In his analysis, Bet-David discussed what a 10% market share of SWIFT's volume could look like for XRP. By his calculations, a $125 trillion yearly transaction volume could push XRP's market cap toward $10 trillion.

Notably, based on these projections, he speculated that XRP could reach a value of $100 per token. In addition, he acknowledged that some analysts also believe the crypto asset

could soar to $1,000

in a scenario where it fully displaces SWIFT.

The financial commentator admitted that the analysts making these predictions may hold XRP themselves. However, he maintained that the projections present an idea of what could occur if XRP realizes its full potential.

He also noted that the ongoing lawsuit from the U.S. SEC has been a major obstacle, delaying institutional adoption. However, he believes a favorable resolution could lead to renewed confidence and broader regulatory acceptance, especially in the U.S., which is crucial for mass-scale implementation.

Ripple Executives Champion XRP as a SWIFT Replacement

Bet-David's remarks are part of a broader sentiment shared by Ripple executives over recent years. Ripple CEO Brad Garlinghouse has long promoted XRP as an alternative to SWIFT.

In an interview in early April, Garlinghouse highlighted XRP's error rate of just 0.1%, a contrast to SWIFT's 6%, and asserted that Ripple's technology presents a better solution for modern financial transactions.

Also, speaking to Fox Business host Maria Bartiromo in March, he shared the belief that Ripple could emerge as a viable rival to SWIFT. Garlinghouse cited growing dissatisfaction with outdated banking infrastructure.

Meanwhile, at the World Economic Forum in Davos this April, Eric van Miltenburg, Ripple's Senior Vice President of Strategic Initiatives,

labeled

Ripple a modern upgrade, or even a replacement, for SWIFT. He pointed out that Ripple's system is faster and significantly more affordable.

Even as far back as November 2018, Garlinghouse made bold claims during a Bloomberg interview, predicting Ripple could eventually dominate over SWIFT. Also, in May 2020, Ripple Chairman Chris Larsen suggested that XRP could replace SWIFT during a Block Stars episode.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/502349.html

Related Reading

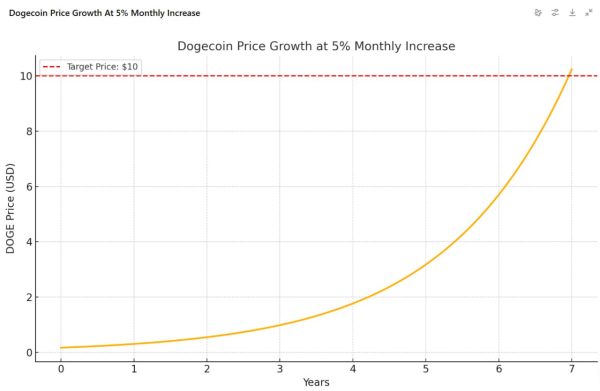

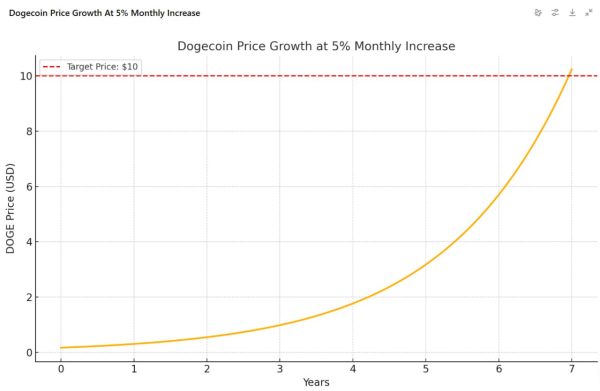

Here is When Dogecoin Can Reach $10 If It Rises only 5% Monthly

The price of Dogecoin could rise to $10 within the next few years if DOGE experiences a steady growt...

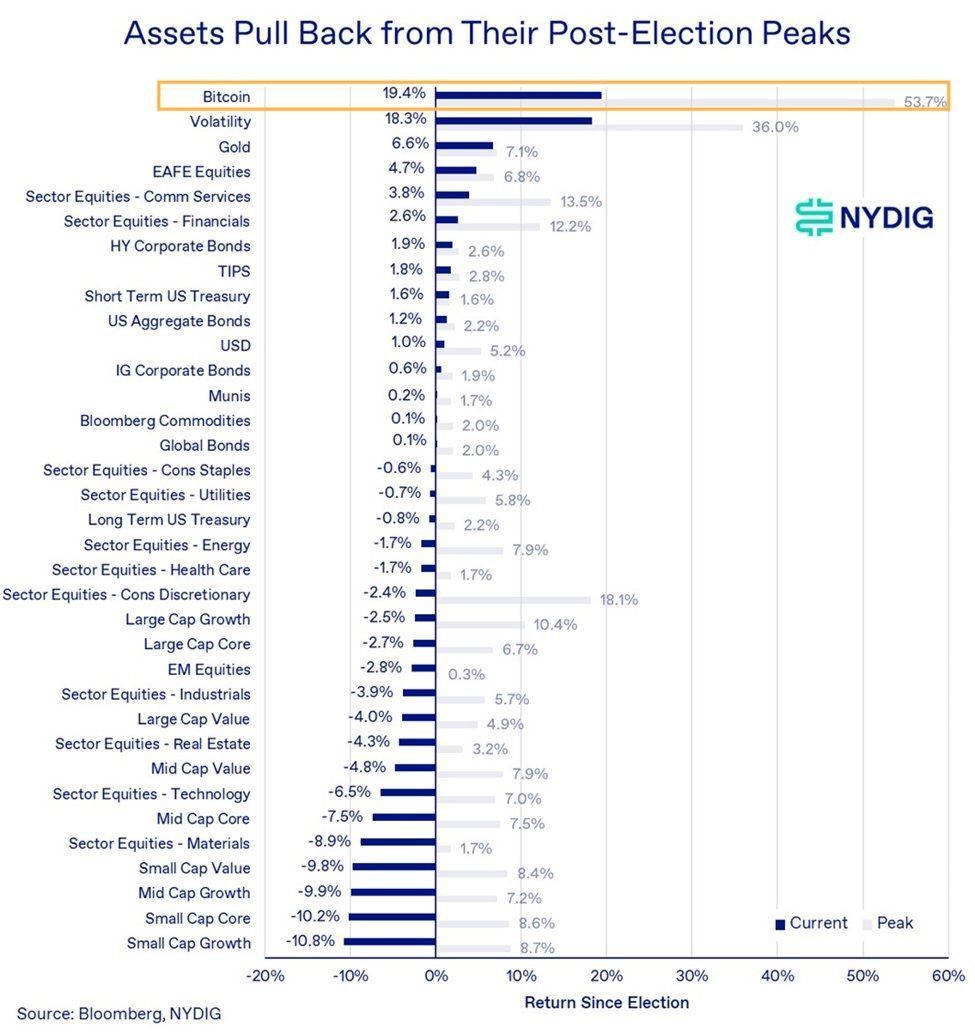

Citigroup Says Bitcoin Resilience in Turbulence Highlights Its Asset Class Value

According to a report by Citigroup, the performance of Bitcoin during recent financial turbulence sh...

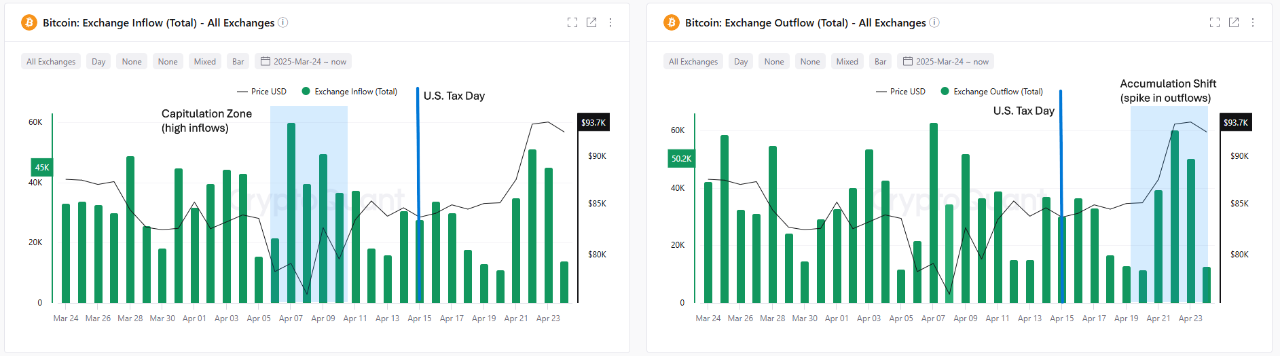

Bitcoin Short Squeeze Looms Amid Spike in Short Positions as Liquidity Builds Around $97K to $100K

The crypto market is currently on high alert as signs point to an imminent Bitcoin short squeeze ami...