Bitcoin Spot ETFs Post Five-Day Inflow Streak, Surging Past $963M in April

- Bitcoin ETFs logged five straight days of inflows totaling $963.55M by April 22.

- April 22 saw the highest daily inflow of $936.43M and record $103.34B in net assets.

- No ETF outflows occurred after April 16, signaling renewed investor momentum.

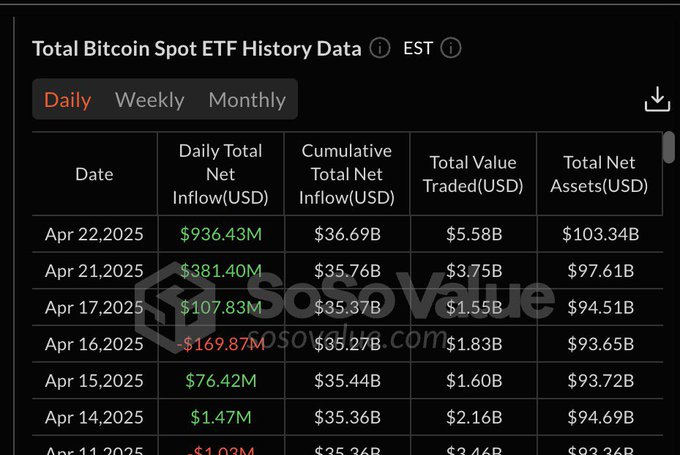

Bitcoin Spot exchange-traded funds (ETFs) have reported five consecutive trading days of net inflows, with $963.55 million entering the market between April 14 and April 22, 2025. The data, tracked in Eastern Standard Time and sourced from SoSoValue, shows a clear pattern of increasing institutional activity through regulated investment vehicles. The latest surge in inflows coincided with a rise in overall trading volumes and total net assets held by Bitcoin ETFs .

Net inflows reached $936.43 million on April 22, the largest inflow, driving total ETF inflows to $36.69 billion. Additionally, total net assets increased to $103.34 billion, the highest amount recorded in the database. The $5.58 billion in trading volume for the day suggests high market activity.

April 22 Records Peak Daily Inflow and Volume

The inflow of $936.43 million on April 22 marked a turning point for the ETFs, significantly exceeding previous days. Total net assets on that date jumped to $103.34 billion, a major rise from the $97.61 billion recorded the day before. The trading volume also reflected the increased interest, with $5.58 billion worth of ETF shares changing hands.

April 21 registered the second-highest inflow of the period, at $381.40 million, with a trading volume of $3.75 billion. These figures indicate that momentum was building early in the week, ultimately leading up to the April 22 spike.

Recovery Follows Earlier Mid-April Volatility

While the second half of April reflected strong buying pressure, the earlier portion of the month included a brief downturn. On April 16, the ETFs saw a net outflow of $169.87 million, temporarily pulling cumulative inflows below $35.3 billion and reducing total net assets to $93.65 billion. April 11 also reported a minor outflow of $1.03 million, though this figure was relatively negligible in the broader trend.

ETF performance began to stabilize in the days immediately surrounding the April 16 outflow. April 17 brought in $107.83 million in net inflows. This was followed by gains of $76.42 million on April 15 and a modest $1.47 million on April 14, signaling the beginning of the recovery streak.

Institutional Participation Drives Asset Growth

By April 22, cumulative inflows across the tracked ETFs stood at $36.69 billion. The rise in total net assets to $103.34 billion indicates major capital movement into Bitcoin-based financial instruments. These numbers also reveal that investor confidence strengthened throughout the month, with consistent inflows and growing volumes suggesting broader institutional involvement.

No outflows were recorded after April 16, reinforcing the perception of a more sustained buying environment. The ETF performance during this window reflects increased market engagement with Bitcoin products through formal investment structures.

Alchemy Pay Enables Global Fiat Access to $DCR via Decred Partnership

The partnership with Alchemy Pay denotes a strategic move to make Decred’s native $DCR token widely ...

Saison Capital, BRI Ventures & Coinvestasi Launches Tokenize Indonesia – a RWA Startup Accelerator

Bangkok, Thailand, 25th April 2025, Chainwire...

Bitcoin Whale Ends Staking Cycle with $25M Loss: A Journey From Peak to Loss

An enormous Bitcoin whale finished an extended cryptocurrency transaction by transferring 800 BTC wo...