DeFi Development Corp (Formerly Janover) Continues Solana Buying Spree

DeFi Development Corp (Nasdaq: JNVR), formerly known as Janover, is aggressively expanding its Solana (SOL) treasury, further signaling its strategic pivot towards the cryptocurrency market following a recent takeover by former Kraken executives. The company announced today the purchase of an additional 65,305 SOL, valued at approximately $9.9 million.

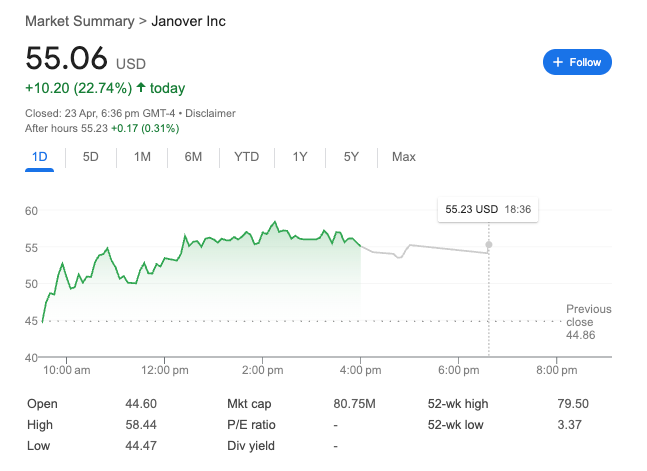

This latest acquisition boosts DeFi Development Corp's total Solana holdings to an impressive 317,273 SOL. This follows a prior announcement on April 22nd, where the company revealed the purchase of 88,164 SOL worth $11.5 million, which had already triggered a 12% jump in its stock price.

The company's rapid accumulation of Solana began after a buyout on April 7th by a team of former executives from the cryptocurrency exchange Kraken . This acquisition marked a clear shift in the company's focus from its previous operations in the real estate financing sector towards a crypto-centric strategy, with Solana identified as the primary asset for its reserve treasury.

Since this strategic overhaul, DeFi Development Corp has executed multiple substantial Solana purchases, including a $10.5 million acquisition on April 16th. The company has explicitly stated its intention to stake its growing SOL holdings, a process of locking up cryptocurrency to support the blockchain network and earn additional yield. Solana has recently seen significant staking activity, briefly surpassing Ethereum in total staked value with a substantial annualized return.

The market's reaction to DeFi Development Corp's focused Solana accumulation has been overwhelmingly positive. The consistent stock price increases following each major purchase highlight a growing investor appetite for publicly listed companies with a clear and aggressive cryptocurrency treasury strategy, particularly one centered around a prominent altcoin like Solana.

Other companies, such as Upexi, are also beginning to explore diversifying their digital asset strategies beyond Bitcoin , further validating the growing trend of corporate crypto treasuries.

SOL is currently trading at $147.81, 2.27% down overnight but 9.42% up over the past week.

Enterprises Embrace Public Blockchain Validation in Seismic Shift

The silent giant of enterprise is awakening, and its embrace of public blockchain validation could b...

The Short-Term Dip Signal We're Waiting For?

Your daily access to the backroom...

Ethereum Foundation Shifts Focus to Near-Term Scaling, User Experience Following Leadership Restructure

This apparent recalibration within the Ethereum Foundation, driven by the new leadership, suggests a...