Bitcoin Bets Surge Even as US Tariff War Triggers an All-Out Plunge

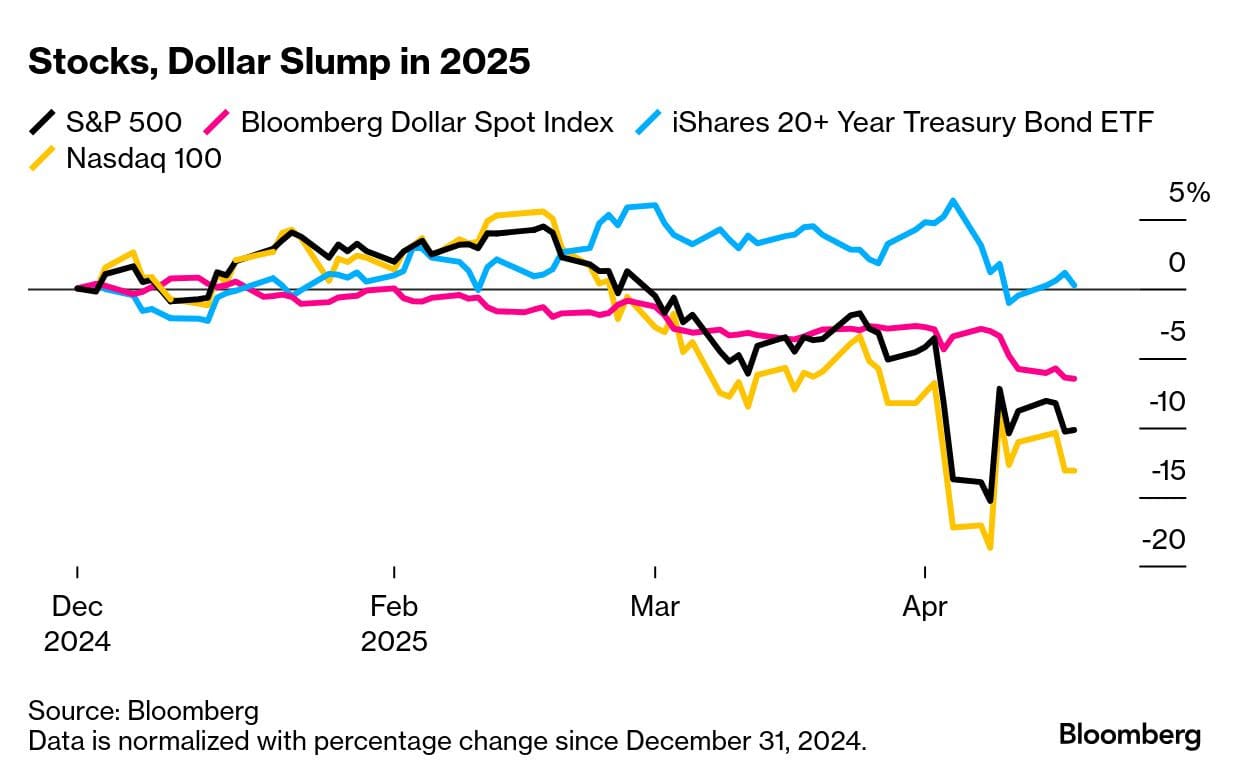

Due to the US tariff war, returns on all investment methods have significantly declined. This includes global equities—both large and small—and the dollar, cryptocurrencies, and corporate debt.

Bitcoin is languishing below the $90,000 mark after hitting a new all-time high on Trump's inauguration day in December 2024. Still, the OG token rose in thin trading as investors seemed to be in a wait-and-watch mode.

Bloomberg Intelligence reports that 90 out of 100 top-performing exchange-traded funds are down in 2025, with an average loss of 13%, due to the impact of tariffs.

This is the latest reflection of investment managers' suffering as the most revolutionary economic program in decades prepares to wreak havoc on American consumers and businesses.

Traders are flooding into safe havens like cash and gold, with proxies for both receiving windfall inflows as Corporate America raises the profit alert and animal spirits retreat due to waning dealmaking.

Markets hit hard by tariffs are falling again, and Wall Street is desperate for a rescue mission after Fed Chair Jerome Powell hinted at markets being on their own, drawing the ire of Donald Trump.

A number of latent trades have begun to show signs of life again; for example, nine out of the twenty equities mutual funds that underperformed in 2024 are actually doing better this year.

Investments in digital assets and high-flying tech equities, which saw ETF gains of up to 150% last year, are already falling significantly in 2025.

This year, the Grayscale Bitcoin Trust ETF has dropped about 10% after a 100 per cent increase in 2024.

In 2025, the Invesco S&P 500 Momentum ETF has fallen 7 per cent after a 45 per cent increase last year, while the Defiance Quantum ETF has fallen more than 10% after a 50% increase.

Powell once again shattered hopes for a speedy recovery from April's market volatility last week when he warned that the economy would be left to face inflation due to rapidly changing trade policies.

President Trump has demanded his dismissal in the latest development of a story expected to captivate investors in the foreseeable future.

Sell America Notion Takes Hold

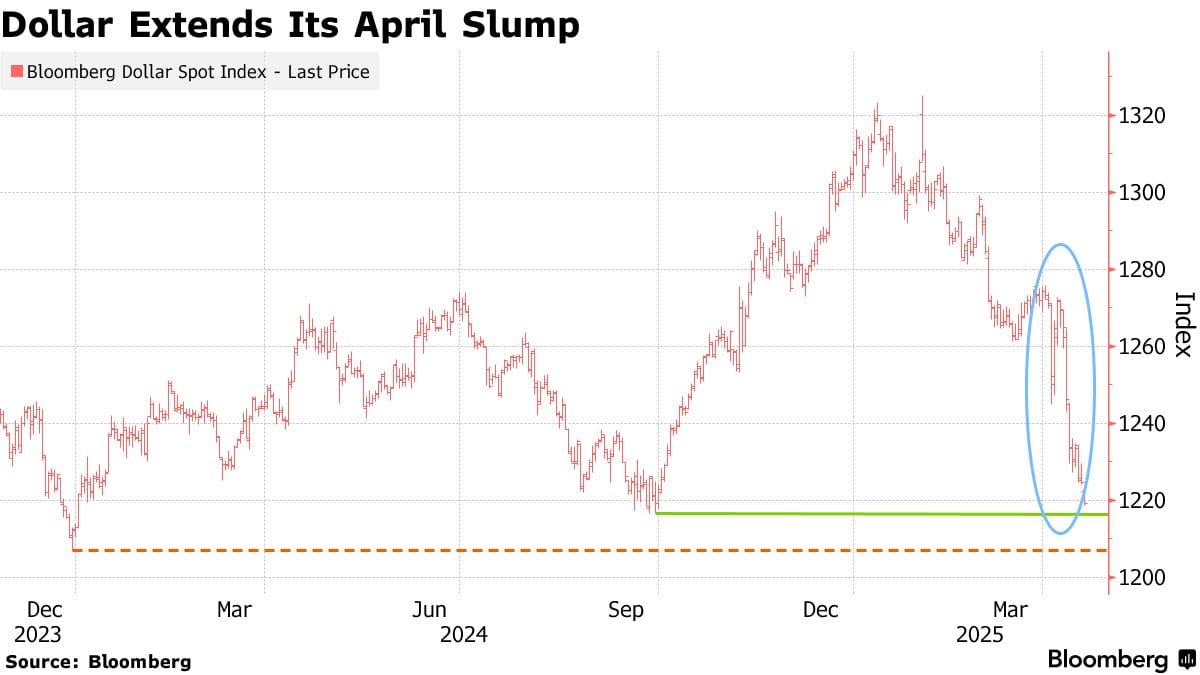

That is another reason for investors to sell American assets, as the dollar gauge fell to its lowest level since January 2024.

Various assets, including tech equities and corporate debt, which experienced a recent spike in January, are causing investment funds to feel the pressure.

Down nine out of the last twelve trading days, the S&P 500 dropped 1.5% for the week.

The dollar's decline this year has reached almost 6%, as it fell approximately 0.7% on the week. The volatility of the Treasury market is still quite high compared to before the election.

With assets surpassing $100 billion for the first time in April, the SPDR Gold Shares is among the top US ETFs in terms of asset accumulation. In 2025, the fund has amassed more than $8.4 billion, surpassing the acquisitions made by the Nasdaq 100 giant QQQ.

After Trump ramped up worldwide tariffs, roiled the Treasuries market, and wiped trillions off global stocks, the once-popular America-first trade—buying assets that win when the US outperforms—is reversing, according to the falls in US assets.

Already dropping for three weeks in a row before the president declared tariffs, a Bloomberg indicator of the dollar's strength continued to decline.

Bitcoin Bids Rise

Despite Bitcoin's volatile April, marked by significant price swings, major holders, or "whales," holding between 10 and 10,000 BTC, have continued to accumulate the cryptocurrency, adding over 53,600 BTC since March 22nd and currently possessing 67.77% of the total supply, according to blockchain analytics firm Santiment, signaling strong confidence and a potential bullish outlook for the market, although a sustained upward trend is contingent on Bitcoin surpassing the $91,000 mark.

Considering the present market dynamics, the ongoing accumulation of Bitcoin by major holders indicates that influential investors may be positioning themselves for a potential upswing, which is a positive sign for the overall market.

This action offers retail traders a strong bullish indication, suggesting that there is sufficient underlying demand to drive and sustain further price growth.

Elsewhere

Blockcast

Licensed to Shill: Current State of Ethereum, Hidden Road Acquisition, Next Gen of Fintech

This week, host Takatoshi Shibayama is joined by Nikhil Joshi, chief operating officer, Emurgo , and Lisa JY Tan, founder and founding economist, Economics Design , to discuss the latest news and developments in the crypto industry.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found on Podpage , with guests like Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our most recent shows.

Vitalik Buterin Proposes Radical Ethereum Overhaul

To tackle long-term scaling limitations, particularly those related to zero-knowledge proving, Vital...

Bitcoin Whales Buy the Dip Amidst April Volatility, Hinting at Future Price Surge

Despite April's wild price swings in the Bitcoin market, data from Santiment reveals that major Bitc...

Long-Term Tailwinds Meet Short-Term Uncertainty - Where We Think the Market is Headed

Your daily access to the backroom....