Bitcoin’s Quiet Bull Signal: On-Chain Trends Hint at Another Price Breakout

Bitcoin has experienced a notable rebound over the past week, following a brief period of downside pressure earlier this month. After dropping below $80,000 amid the tariff turmoil, the asset has regained its losses and is now trading above $85,000 .

This recovery marks a nearly 10% surge over the last seven days and comes as investors reassess macroeconomic cues and on-chain signals .

Bitcoin On-Chain Trends Indicate Continued Uptrend

The market’s resilience appears to be underpinned by several important metrics. According to a recent post by CryptoQuant analyst BorisVest, various on-chain indicators continue to suggest that Bitcoin remains undervalued in the current cycle.

The analysis points to declining exchange reserves, a stablecoin supply ratio that suggests available liquidity for new purchases, and normalized funding rates that may indicate a reduced risk of overheated market conditions.

One of the striking observations in BorisVest’s analysis is the ongoing reduction in exchange-held Bitcoin reserves, which have now returned to levels not seen since 2018.

The total number of BTC on exchanges stands at around 2.43 million, significantly down from the 3.4 million observed during the 2021 bull market peak.

This reduction implies a shift toward long-term holding behavior among investors, limiting available supply for immediate sale and potentially contributing to upward price pressure .

In addition, the Stablecoin Supply Ratio (SSR) currently stands at 14.3. The SSR is a metric used to gauge the purchasing power available in the market via stablecoins.

A lower SSR indicates higher purchasing power and potential for further buying activity. Since the SSR has not reached the elevated levels seen during the last cycle’s peak, the data implies that capital remains on the sidelines and could be deployed as prices stabilize or rise.

Normalized Funding Rates and Bullish Implications

Another significant factor highlighted in the report is the normalization of funding rates. During Bitcoin’s recent all-time highs, funding rates spiked as long positions accumulated rapidly, suggesting an overheated market and increased short-term risk.

However, since the correction, these rates have returned to neutral territory, now hovering between 0.00% and 0.01%. This return to balance is interpreted as a reset of market sentiment , reducing the likelihood of immediate downside caused by over-leveraged longs.

The report concludes that the combination of declining exchange reserves, a stable SSR, and subdued funding rates supports a constructive outlook for Bitcoin in the near term.

While broader macroeconomic factors, such as the global tariff environment and monetary policy, will continue to influence sentiment, current on-chain dynamics suggest that investor confidence remains intact .

The focus now shifts to whether these conditions will translate into sustained upward momentum or if a period of consolidation will take hold before the next major move.

Featured image created with DALL-E, Chart from TradingView

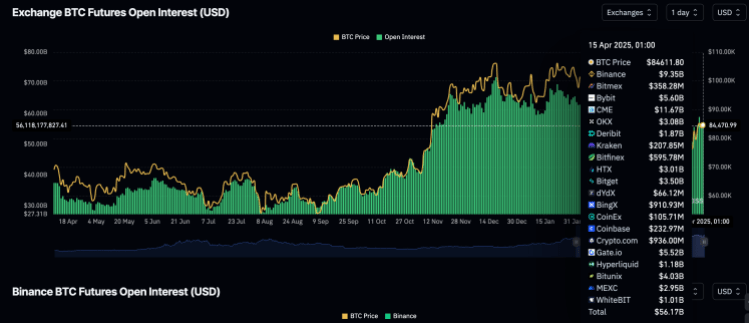

Is The Bitcoin Open Interest Too High Or Can The BTC Price Still Rally?

The Bitcoin open interest has remained on the high side despite the price declines, suggesting that ...

XRP Price Under The Microscope: Top Expert’s Update Sets $10 Target

As the XRP price climbs back above the crucial $2 mark, reflecting a 20% surge over the past week, m...

Is The Storm Over For Ethereum? Analyst Says ‘Face-Melting’ Rally Comes Next

Ethereum (ETH) continues to hold a crucial support level after recovering from last week’s correctio...