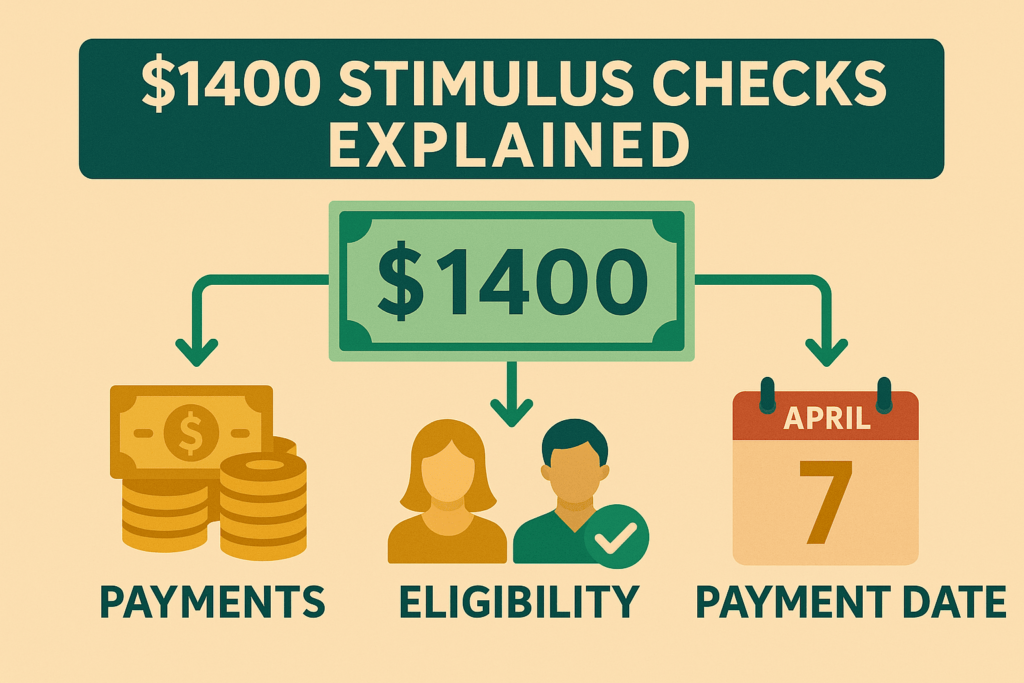

$1400 Stimulus Checks Explained: Economic Lifeline or Inflation Trigger?

Introduction

The COVID-19 pandemic prompted unprecedented fiscal intervention in the United States, with three rounds of Economic Impact Payments designed to support households through lockdowns, job losses, and economic uncertainty. Among these, the third payment—commonly referred to as the $1400 stimulus checks—became a focal point of policy debate and public interest.

Under the American Rescue Plan Act of 2021, eligible individuals received up to $1,400 per person, marking the largest single direct payment in U.S. history to that point. This article delves into the origins, mechanics, impacts, and controversies surrounding the $1400 stimulus checks, offering a comprehensive look at their role in America’s pandemic recovery.

A Brief History of Economic Impact Payments

The U.S. government first deployed Economic Impact Payments in March 2020 under the CARES Act, distributing up to $1,200 per adult and $500 per child. A second round followed in December 2020, providing up to $600 per person. The third and final round—the $1400 stimulus checks—arrived in March 2021 as part of President Biden’s American Rescue Plan. Unlike previous payments, this round expanded eligibility by increasing the income thresholds for phase-outs and extending benefits to adult dependents, broadening its reach to millions more Americans.

Mechanics of the $1400 Stimulus Checks

Under the American Rescue Plan, individuals with adjusted gross incomes (AGI) up to $75,000 qualified for the full $1,400 payment, with a gradual phase-out for incomes up to $80,000. Married couples filing jointly received up to $2,800, plus $1,400 per qualifying dependent with a valid Social Security Number. This structure aimed to direct aid to low- and middle-income households, who are more likely to spend immediately on necessities, thereby stimulating economic activity.

Dependents and Family Considerations

A notable expansion in this round was the inclusion of adult dependents—such as college students and elderly relatives—who had been excluded from earlier payments. Households could claim $1,400 for each dependent, effectively increasing relief for multi-generational families and caregivers. According to a Jain Family Institute analysis, 78% of Americans approved of a third-round payment of this size, indicating strong public support for inclusive relief measures.

Claiming Process and Deadlines

Although most eligible recipients received their payments automatically, individuals who did not file a 2021 tax return risked missing out. The IRS offered a Recovery Rebate Credit on the 2021 return to capture unclaimed funds, with a firm deadline of April 15, 2025, to file and claim the credit. After this date, unclaimed payments—totaling over $1 billion—will revert to the U.S. Treasury. Taxpayers can still access missing payments by filing a 2021 return or, for non-filers, using IRS Free File tools.

IRS Automation and Outreach

Recognizing the complexity of claiming credits, the IRS announced an automatic “plus-up” payment in December 2024 for approximately one million taxpayers who had filed but failed to claim the Recovery Rebate Credit. These payments, sent without additional action, ensured that eligible individuals received their full $1,400 entitlements by early 2025. The IRS also sent personalized letters to notify recipients and provided online account tools for tracking payment status.

Household Spending Patterns

Academic studies reveal that stimulus payments influenced household financial behavior in diverse ways. A Brookings analysis found that many households used the funds to bolster savings or pay down debt, while others increased spending on durable goods like appliances and vehicles. The immediate spending response averaged around 22% of the payment, with the remainder contributing to stronger balance sheets as the economy rebounded. This mix of saving and spending underscored the dual goals of economic stabilization and individual financial security.

Macroeconomic Effects

Beyond individual households, the $1400 stimulus checks contributed to broader economic recovery. The Brookings Institution estimated that the American Rescue Plan boosted GDP by approximately 4% by the end of 2021 and sustained a 2% lift into 2022, primarily through increased consumer demand and reduced household debt burdens. Fiscal multipliers varied over time, but the combined effect of direct payments, expanded unemployment benefits, and small business support played a critical role in averting deeper recessionary pressures.

Public and Political Response

Public sentiment largely favored direct payments, with polls indicating high approval for the $1400 stimulus checks—particularly among low- and middle-income earners. However, debates emerged over the adequacy of the amount, with some legislators advocating for a $2,000 payment to further support vulnerable populations. The Vox policy team noted that progressive lawmakers, including Rep. Alexandria Ocasio-Cortez, pushed for larger checks, arguing that $1,400 was insufficient to meet ongoing needs.

Criticisms and Concerns

Critics warned that large stimulus payments risked fueling inflation. FiveThirtyEight highlighted analyses linking direct payments to surges in consumer demand, which may have contributed to higher prices in goods and services during 2021. A Federal Reserve Bank of San Francisco study estimated that pandemic-era fiscal support—including the $1400 stimulus checks—added roughly three percentage points to core inflation by year-end 2021. Nonetheless, many economists argue that without such support, the economy could have faced a more severe contraction.

Future Outlook

While no new rounds of $1400 stimulus checks are currently planned, policymakers continue to explore targeted relief for sectors still struggling post-pandemic, such as hospitality and small businesses. The unclaimed funds deadline of April 15, 2025, serves as a reminder of the importance of timely tax filing to access available credits. Lessons from the 2021 payments will inform future crisis response strategies, balancing immediate relief with long-term economic stability.

The $1400 stimulus checks represented a landmark effort to provide direct financial relief during one of the most challenging periods in recent history. By offering substantial, broad-based payments, the American Rescue Plan supported millions of households, stabilized consumer spending, and contributed to a faster economic recovery. Despite debates over their size and inflationary effects, these payments show the power of direct fiscal intervention in times of crisis—and set a precedent for future policymaking in the face of economic emergencies.

Interview with Neiro CTO Lead S: Reviving Neiro Through Decentralization and Community Governance

CTO Lead S shares how Neiro was reborn after abandonment, how the team fights rug pulls, and what ma...

Dialectic Group set to deploy up to $15million USD equivalent on Haven1

Zug, Switzerland, 16th April 2025, Chainwire...

CoinGecko Q1 Crypto Report Indicates Strong Market Performance Despite Volatility

CoinGecko’s 2025 Q1 Crypto Industry Report signifies a resilient performance throughout the first qu...