Janover Inc. Accumulates $9.6 Million SOL for Staking, What’s Driving Solana Price Rise?

Solana (SOL) seems bullish as whales have renewed accumulation of the token, possibly suggesting an imminent rally. Today, April 14, CoinRank shared data disclosing that US-based SaaS firm Janover INC has bought 44,158 SOL tokens worth $5 million Solana for staking.

Whale adds over 44,158 SOL

This is the second purchase, making the real estate financing company now hold a total of 83,084 SOL valued at $9.6 million. Based on the company’s crypto-driven treasury policy, Janover will start staking the SOL tokens to help secure and support Solana network’s operations, as a result, generate rewards.

This move comes after Janover’s board recently integrated cryptocurrency into the company’s corporate treasury strategy. With its long-term crypto treasury strategy, the firm started SOL accumulation and staking, hinting that the firm is set to acquire other favourite crypto assets soon.

Solana price updates

While the whale’s token transfer has sent waves through the crypto market, it raises questions about SOL’s price movement. The whale’s activity has already caused a 1.9% rise in SOL’s market price, highlighting how big token transfers can stimulate the market.

A large movement of funds can immensely impact market stability and liquidity. Whenever a significant quantity of assets is withdrawn or dumped on-chain, it triggers an abrupt shock, resulting in price volatility.

Strategic staking often helps build stability in the crypto market, especially during turbulent times. By staking, investors lock up assets for a particular period, decreasing supply on exchanges and creating price support levels. This approach lessens price fluctuations by suppressing panic selling during downturns.

Such a huge withdrawal suggests that whales are accumulating SOL tokens, driving SOL price gains. The asset price is currently standing at $132.34, up 2.3% from yesterday. Its value has been up 30.1% and 5.1% over the past week and two weeks ago, respectively, an indication of token accumulation by investors and long-term buyers.

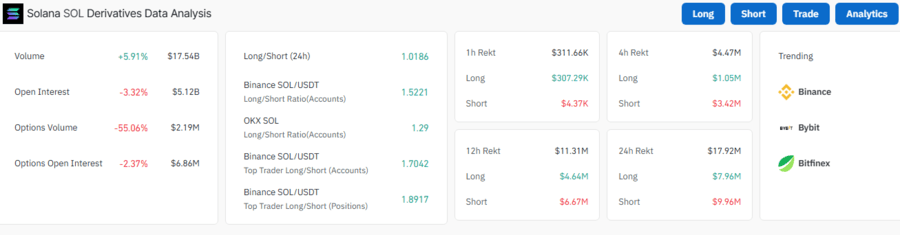

As per metrics from Coinglass, Solana’s transaction volume rose by $5.91% from yesterday to $17.54 billion. This increase shows a significant outflow of SOL tokens from exchanges, suggesting substantial token acquisition that could trigger buying pressure and potential upward movement. Whale and long-term buyers appear to be capitalizing on a recent market dip to purchase a large quantity of SOL tokens.

Binance Face Brief Outages Following AWS Data Center Issue

Binance, KuCoin, and MEXC briefly halted services after an AWS outage in Tokyo. All exchanges resume...

Supernet AI and Port3 Network Partner to Transform Decentralized Intelligence

Supernet AI is scaling decentralized AI in collaboration with Port3 Network by enabling smarter agen...

6 Best Altcoin Picks This Week That Could Outperform ETH

6 top altcoin picks this week, including breakout project $XYZ, show strong potential to outperform ...

BREAKING: U.S.-listed firm Janover Inc. has acquired an additional 44,158

BREAKING: U.S.-listed firm Janover Inc. has acquired an additional 44,158

The company will begin staking its new

The company will begin staking its new