Crypto Market Outlook April 2025: DCA Strategy May Pay Off

The post Crypto Market Outlook April 2025: DCA Strategy May Pay Off appeared first on Coinpedia Fintech News

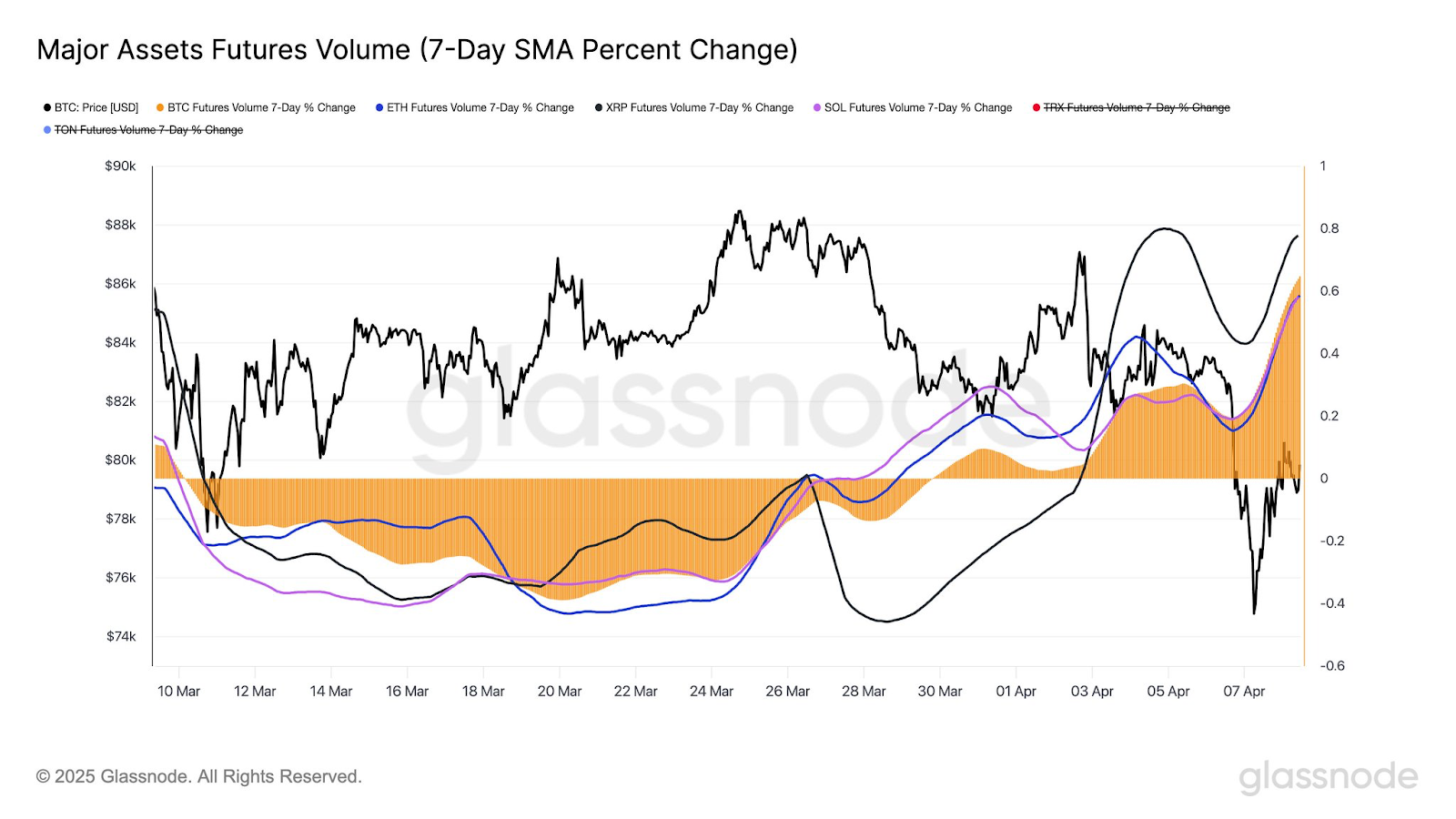

The wider crypto market has continued to showcase resilience after the Asian and European stock markets recorded bullish sentiment on Tuesday. Bitcoin (BTC) has attempted to regain crucial support levels above $80k in the past two days in vain, triggering a spike in crypto speculative trading, especially perpetual and futures contracts trading.

Is the Crypto Dip Over?

Following the mainstream adoption of cryptocurrencies by institutional investors and rising new regulatory standards in major jurisdictions, Bitcoin price action has led the wider altcoin industry to follow major global stock indexes.

From a technical and fundamental analysis standpoint, the rising crypto futures and perpetual contract trading have increased the correlation between Bitcoin and the wider altcoin. In the four-hour time frame, Bitcoin price has been confirming a macro reversal pattern, after forming lower highs and lower lows.

As a result, a consistent close above the liquidity level between $88k and $93k will confirm a fresh rally beyond $100k. However, macro bearish sentiment has the upper hand, with a possible BTC drop towards $73k, which coincides with the 1.618 daily Fibonacci Extension .

Bigger Picture

With Bitcoin and the wider crypto market having been identified as a global economic game changer by the United States and top BRICS countries, it is safe to say a crypto correction bottom has already happened or is very close.

Consequently, monitoring the trade war between China and the United States will offer a signal of crypto market reversal.

Nonetheless, conducting Dollar Cost Averaging (DCA) from now will turn profitable in the second half of 2025 amid anticipated U.S. and global recession.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Dogecoin L2 Brewing: Timothy Stebbing Highlights Future Developments For DOGE

The post Dogecoin L2 Brewing: Timothy Stebbing Highlights Future Developments For DOGE appeared firs...

Gold Price Soars Past $3,340: When Will Bitcoin Price Catch Up?

The post Gold Price Soars Past $3,340: When Will Bitcoin Price Catch Up? appeared first on Coinpedia...

Ethereum Fees Hit 5-Year Low: Can Ether Bulls Seize the Opportunity?

The post Ethereum Fees Hit 5-Year Low: Can Ether Bulls Seize the Opportunity? appeared first on Coi...