Solana Price Prediction for April 1: Can SOL Recover After Dropping 5%?

- Solana’s price drops 5% after U.S. tariff announcement, reflecting broader market decline.

- Futures market data shows growing interest in Solana despite recent price dips.

- Technical indicators suggest potential for price reversal with increased buying pressure.

Solana (SOL) has recently recorded a decline in its price, mirroring the broader trends in the crypto market. Following the U.S. president’s announcement regarding new tariffs, SOL dropped by 5% within 24 hours.

This price movement reflects a larger market downturn, with many cryptocurrencies losing between 3% and 4% of their value. Despite these short-term fluctuations, analysts remain optimistic about Solana’s potential for a recovery, with projections indicating a possible price target of $220 before April 10th.

Solana had been on an upward move before the tariff announcement disrupted the market, causing SOL to fall below the $145 mark. However, some analysts see the price drop as temporary.

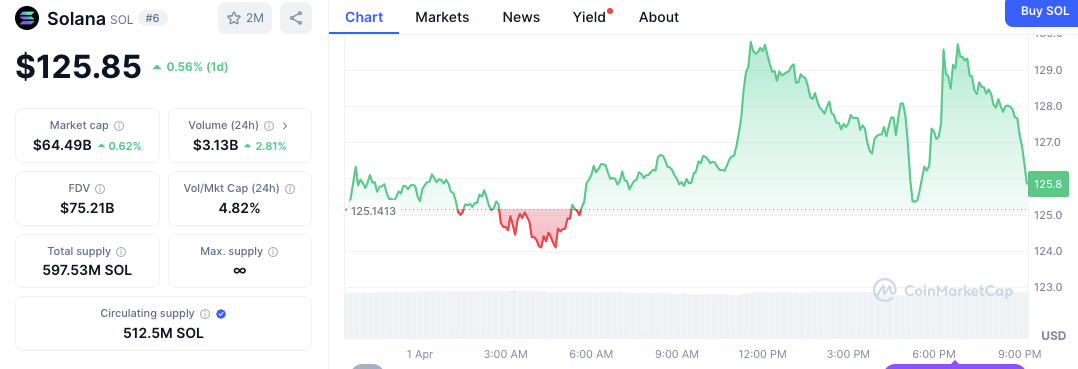

However, as of press time, Solana was trading at $125.85, recording a 0.56% increase over the past 24 hours. SOL’s market capitalization has reached $64.49 billion, with a 24-hour trading volume of $3.13 billion, reflecting a 2.81% increase in trading activity.

Over the past day, the price fluctuations saw Solana drop below $125, followed by an increase above $128, before settling back at $125.85. SOL’s circulating supply stands at 512.5 million, with a total supply of 597.53 million, while the cryptocurrency’s trading volume relative to its market cap is 4.82%, suggesting healthy trading activity and market engagement.

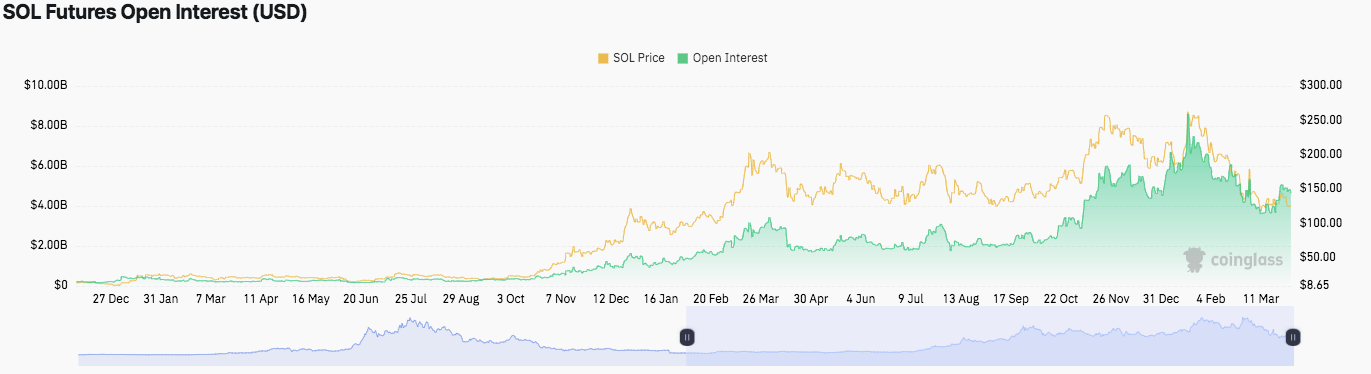

Solana’s Futures Open Interest Shows Growing Interest

In addition to the price movements, Solana’s futures market data indicates increasing interest in the cryptocurrency. Over recent months, both SOL’s price and its future open interest have risen. From late December 2024 to early March 2025, SOL’s price surged from around $10 to over $150, matching a spike in open interest.

Despite recent price dips, future data reveals that market participants are still actively engaging with Solana, with both price and open interest seeing growth. This suggests that while short-term fluctuations may occur, the longer-term outlook for Solana is likely to be influenced by ongoing market speculation and interest in its future potential.

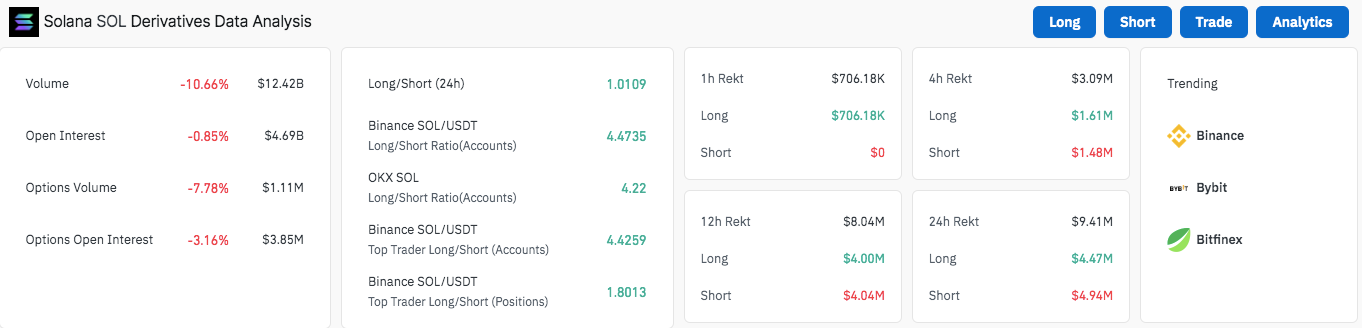

Derivatives Market and Sentiment Analysis

Solana’s derivatives market has also experienced fluctuations. Over the past 24 hours, the trading volume for Solana has decreased by 10.66%, totaling $12.42 billion. Open interest in SOL futures has seen a slight drop of 0.85%, standing at $4.69 billion. In the options market, volumes have decreased by 7.78%, with open interest falling by 3.16%.

Solana’s long/short ratio currently stands at 1.0109, indicating a balanced sentiment in the market. Binance, the largest exchange for SOL, reports a higher long/short ratio of 4.4735, suggesting that traders lean more toward long positions.

Technical Indicators Signal Potential for Reversal

In terms of technical indicators, Solana’s Relative Strength Index (RSI) is currently sitting at 42.63, suggesting that SOL is slightly bearish at the moment but not yet in oversold territory.

The MACD indicator suggest a positive direction but it remains that the MACD is below the signal line. On the MACD, a crossover of the MACD line above the signal line will give a buy signal.

FAQs:

Why did Solana’s price drop recently?

Solana’s price dropped by 5% after the U.S. president announced new tariffs, mirroring broader market trends. This decline is part of a larger crypto market downturn, with many cryptocurrencies losing 3% to 4% of their value.

What is Solana’s price and market cap as of now?

As of the latest data, Solana is trading at $125.85, with a market capitalization of $64.49 billion. The cryptocurrency’s 24-hour trading volume is $3.13 billion.

Are analysts still optimistic about Solana’s future?

Yes, analysts project that Solana could recover and reach a price target of $220 before April 10th. Despite recent declines, future data and market interest suggest a positive long-term outlook.

Solana Records Massive Token Creation in March

As per the data from SolanaFloor, just in March, the platform (Solana) witnessed the creation of ove...

$USDD Goes Live on Kraken Exchange with Complete Withdrawal and Deposit Support

By listing $USDD on its platform, Kraken reportedly enables seamless trading, withdrawals, and depos...

Shiba Inu Price Prediction for April 2: Can SHIB Stabilize After Dropping to $0.0000122?

Shiba Inu drops 5 percent to $0.0000122 as Shibarium surpasses 1 billion transactions while $SHIB tr...