Bitcoin Nears Worst Q1 Close Since 2018: Will Bearish Metrics Push BTC Price Below $80K?

The post Bitcoin Nears Worst Q1 Close Since 2018: Will Bearish Metrics Push BTC Price Below $80K? appeared first on Coinpedia Fintech News

The crypto market’s recent recovery faded on Friday as a sharp sell-off erased nearly all weekly gains. Investors turned cautious amid concerns over President Trump’s upcoming tariffs scheduled for April 2 along with stronger-than-expected core PCE data. With Bitcoin facing rising selling pressure below $85,000, it’s on track for its worst quarter since 2018, allowing analysts to speculate whether it might finish March below the critical $80,000 level.

Bitcoin to Face Worst Q1 Since 2018

Bitcoin’s price has sharply declined over the past several hours. According to Coinglass data, nearly $90.56 million in BTC positions were liquidated, including $79.3 million from buyers and about $11.25 million from sellers.

This recent price drop places Bitcoin on track for its worst Q1 performance since 2018. Data from CoinGlass indicates Bitcoin fell roughly 11.86% in Q1 2025, slightly worse than the 10.83% loss in Q1 2020, though far from the drastic 49.7% decline seen in Q1 2018.

Bitcoin’s open interest has declined by roughly 4.5% in the past 24 hours, moving closer to a low of around $54 billion. The drop in open interest indicates declining trading activity among BTC traders, which may result in decreased volatility and more cautious market behavior in the short term.

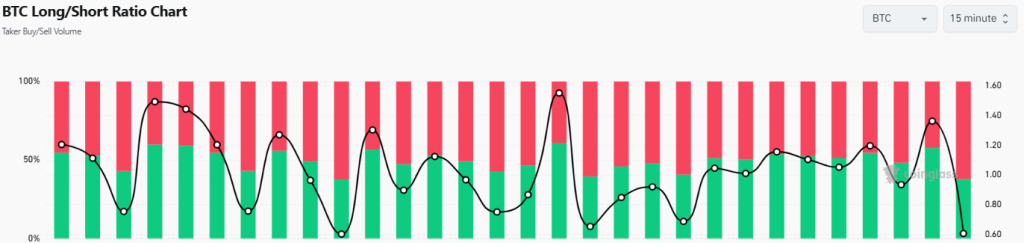

Additionally, the long/short ratio has experienced a noticeable decline, currently standing at 0.6051. This metric reveals that approximately 62.3% of traders are now betting on a further price decrease for Bitcoin, whereas only around 38% are hopeful about a potential rebound. Overall, these figures point to an increasing bearish sentiment among traders.

Also read: Bitcoin ETF Inflow Streak Breaks After 10-Day Surge

Adding to bearish sentiment, Bitcoin ETFs experienced notable outflows, possibly pushing BTC closer to the $80K level. Fidelity’s FBTC fund alone saw $93.16 million in outflows on Friday, ending a 10-day streak of inflows—the longest this year. Notably, FBTC had received $97.14 million of inflows just the previous day, as per SoSoValue. Trading volume across all U.S. Bitcoin ETFs increased slightly on Friday, totaling around $2.22 billion.

What’s Next for BTC Price?

Bitcoin has recently experienced increased selling pressure, causing its price to fall below significant Fibonacci support levels and reaching a low of around $81,644. At present, Bitcoin trades near $82,289, down approximately 1.7% over the past 24 hours.

Sellers are actively holding the crucial resistance at $85,000, aiming to keep the price from bouncing back. Despite this, buyers remain determined and appear prepared for another push to reclaim this key level.

If buyers manage to regain the $85,000 level, market sentiment could shift positively, potentially paving the way for further upward momentum toward the next major resistance near $90,000.

However, if buyers are unsuccessful in overcoming this critical barrier, Bitcoin could face increased selling pressure, possibly dragging the price back toward the support zone between $80,000 and $78,000.

Scam Warning: Is Gemini Filing for Bankruptcy? Phishing Email Spreads Panic

The post Scam Warning: Is Gemini Filing for Bankruptcy? Phishing Email Spreads Panic appeared first ...

Where to Buy Influencer Pepe Before It Hits Major Exchanges!

The post Where to Buy Influencer Pepe Before It Hits Major Exchanges! appeared first on Coinpedia Fi...

Bitcoin (BTC) Drops Toward Range Lows While Whales Accumulate a New Token Priced at $0.025

The post Bitcoin (BTC) Drops Toward Range Lows While Whales Accumulate a New Token Priced at $0.025 ...