GameStop Announces $1.3 Billion Debt Offering to Fund Bitcoin Acquisition

Just a day after announcing its foray into Bitcoin as a treasury reserve asset, GameStop Corp. (NYSE: GME) has unveiled plans for a significant $1.3 billion private offering of convertible senior notes.

GameStop explicitly stated the intention to use the net proceeds "for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with GameStop’s Investment Policy," according to an announcement .

The company intends to grant the initial purchasers an option to buy an additional $200 million in notes. These notes will be general unsecured obligations of GameStop, will not bear regular interest, and will mature on April 1, 2030, unless converted, redeemed, or repurchased earlier. Upon conversion, GameStop will have the option to pay or deliver cash, shares of its Class A common stock, or a combination thereof.

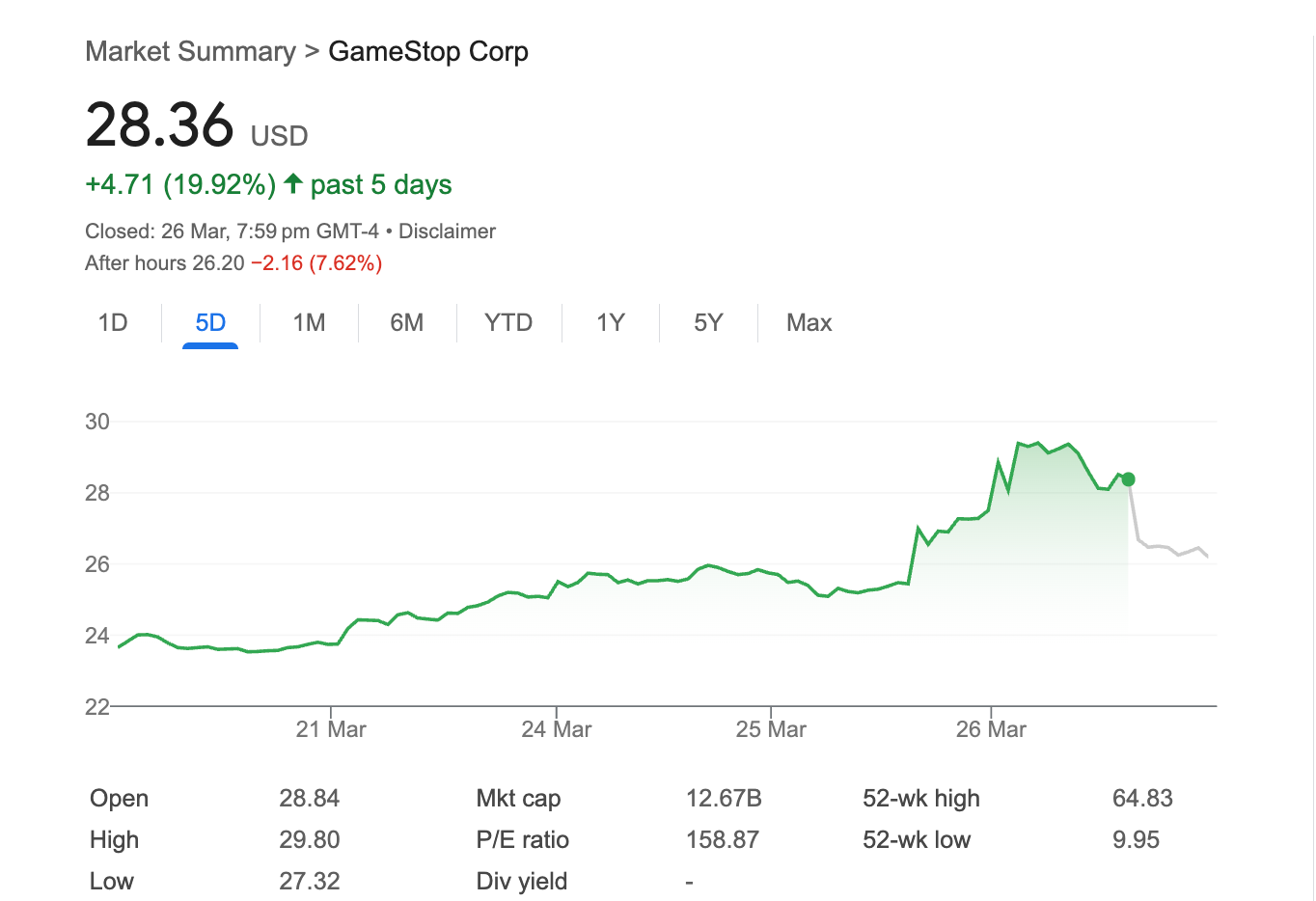

The announcement of this debt offering closely follows GameStop's declaration on Tuesday that its board had approved an update to its investment policy to include Bitcoin and U.S. dollar-denominated stablecoins as treasury reserve assets. This news had sent GameStop's shares soaring by 16% on Wednesday as investors reacted positively to the company's embrace of cryptocurrency.

However, the enthusiasm was tempered by the subsequent announcement of the $1.3 billion debt offering. GameStop's shares dropped by 8% in Wednesday's after-market trading, erasing a significant portion of the day's earlier gains. Investors appear to be weighing the potential benefits of holding Bitcoin on the balance sheet against the implications of taking on a substantial amount of debt.

Convertible senior notes are debt securities that can be converted into equity (in this case, GameStop's Class A common stock) at a later date, typically at the holder's option. This type of financing has been notably employed by Strategy (formerly MicroStrategy), which has amassed a vast Bitcoin treasury valued at over $40 billion and has seen a significant correlation between its stock price and the price of Bitcoin.

GameStop's move to raise a substantial sum through convertible debt to purchase Bitcoin echoes Strategy's playbook. The company reported holding $4.8 billion in cash during its fourth-quarter earnings on Tuesday, and this debt offering will significantly bolster its financial resources for its new investment strategy.

GameStop's stock closed at $28.36 on Wednesday, down 9.5% year to date.

Blockcast 56 | Lombard Co-Founder Jacob Phillips on Bitcoin DeFi's Challenges and Innovations

Jacob Phillips entered crypto in 2018, co-founded Lombard in 2024, focusing on Bitcoin liquidity and...

Top Crypto Stories This Week: From a Blockhead B.R.O Introduction to a Blockhead Bro Farewell

Blockhead's B.R.O. spreads its wings while a Blockhead bro flies solo...

Nigeria Continues Search for Escaped Binance Exec Nadeem Anjarwalla

Nigeria continues its pursuit of Binance exec Anjarwalla, who fled to Kenya after escaping custody...