Markets' Mantra: Bears Take Control as Risk-Off Tone Keeps Cryptos at Bay

Markets start the week on a risk-off note as traders navigate geopolitical uncertainties and indications that the impending next phase of Donald Trump's trade wars may be targeted.

Speculative digital assets were hit hard by a cryptocurrency drop on Sunday, with the sector bearing the brunt of the market selloff as investors reduced risk in response to US President Donald Trump's tariff rhetoric.

However, on Monday, Bitcoin found some footing on signs that the next round of tariffs could be watered down.

The OG token gained nearly 2% to trade close to $86,000 on Monday after falling about 4.3% on Sunday in a broad crypto selloff.

Sunday trading saw an 8% loss in Ethereum, the second-largest cryptocurrency by market value, with so-called alternative coins experiencing more severe selling.

A digital asset surge was sparked by Trump's election triumph on December 8, but Dogecoin, which counts Elon Musk among its backers, plummeted almost 14% in Sunday's session, bringing its price down by 45% from its all-time high.

Four alternative cryptocurrencies—XRP, Cardano, Avalanche, and Chainlink—fell by more than 10%.

While Bitcoin saw a reversal early on Monday, the rest of the crypto universe was in the red, with Ethereum still bleeding.

Markets have reacted extremely negatively to Trump's economic broadsides, but the president hasn't backed off and has instead raised the spectre even further with announcements on social media posts and interviews almost daily.

The uncertainty of 'will he, won't he' has weighed on investor sentiment, which has been pronounced in crypto moves.

The weekend moves indicate that financial markets will experience a rough ride this week due to Trump's tariff declarations.

American officials are concerned that the president's decision to impose 25% tariffs on Canadian and Mexican goods and 10% on Chinese goods could disrupt international trade and spark a new trade war with tit-for-tat responses from the country's trading partners.

Alternative currencies like Bitcoin are not immune to the ripple effect of fears of stagflation from trade wars, which can lead to recessions.

Dot-Com Era va. Current Market Trends

The deep selloff in broader risk markets has wiped out trillions of dollars, and investors are comparing the current trend to the dot-com bubble burst.

There are some parallels between the two periods but also significant distinctions. For example, modern tech companies are far more secure financially than the dot-com firms of yesteryear.

The seemingly endless potential of a new, groundbreaking technology enthrals investors.

The euphoria sets off a stock market upswing to new records. Share prices get absurd when things get too hot, and a total breakdown follows.

Does that ring a bell?

The dot-com boom burst exactly 25 years ago, causing investors to lose trillions of dollars. The S&P 500 Index reached a record high on March 24, 2000, but it wasn't surpassed until 2007.

The tech-heavy Nasdaq 100 Index closed at an all-time high three days later; it would be more than fifteen years before it did so again.

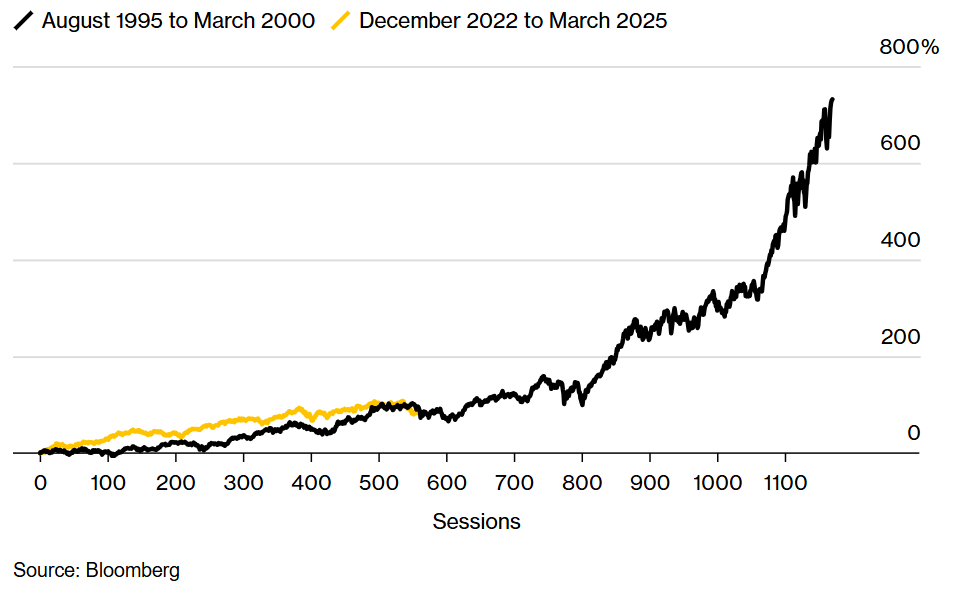

Those high points were the last in a thrilling run beginning in August 1995 with Netscape Communications' blown-out initial public offering.

Between those two points and March 2000, the S&P 500 would nearly triple, and the Nasdaq 100 would rise by 718%.

But that was the end.

By October 2002, more than 80% of the Nasdaq's value had evaporated, and the S&P 500 had been practically halved.

Those echoes are visible in the current market trend. Artificial intelligence ( AI ) is the new technology this time around.

There are clear indications of instability following a stunning stock market surge that added over $22 trillion to the valuation and brought the S&P 500 soaring 72% from its trough in October 2022 to a new all-time record last month.

The Nasdaq 100 has since lost almost 10% into correction territory, while the S&P 500 also momentarily fell to that level; stock prices are beginning to decline significantly.

Worse yet, the symmetry brings up terrifying memories from 25 years ago.

Dot-com Surge More Extreme

What has not changed in investors are two primary emotions—fear and greed.

But the degrees of moves are the key distinction between then and now.

The latest surge was spectacular, but nothing compared to the internet bubble's extremes.

Still, the closure of many top firms back then is what Wall Street worries about now.

The other distinction, and perhaps the most important, is the tech firms' capabilities of generating cash flow today.

There is a striking contrast between the dot-com era's dominant corporations and those participating in the AI boom.

Yet-to-be-successful new companies sprang up all over the internet during its bubble, and some of them took advantage of the craze by adding a ".com" to their names for better IPO debuts.

However, this time, AI enthusiasm is concentrated in a few big tech businesses that rank among the world's most lucrative and secure organizations.

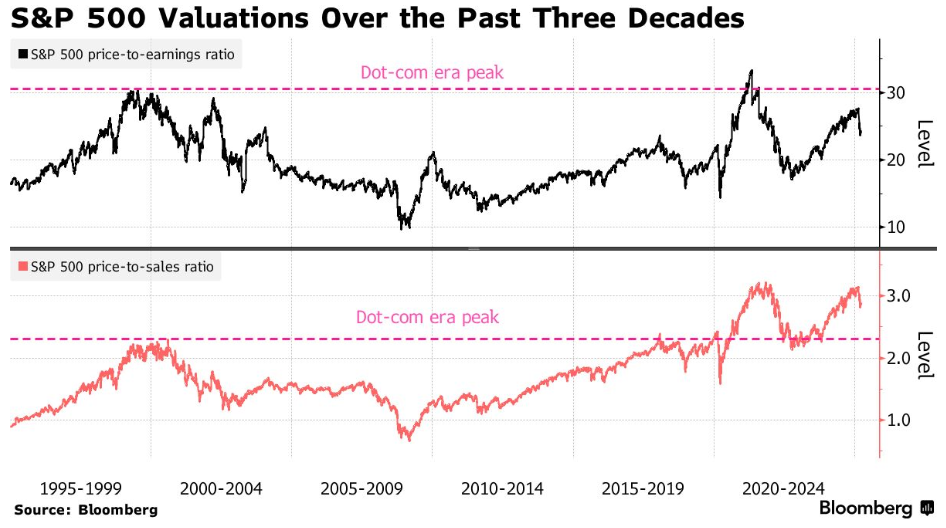

Traditional metrics, such as price-to-earnings ratios, make comparing equity prices between the two periods difficult due to the variations between the corporations generating the enthusiasm.

According to estimations made at the time, the majority of the internet boom companies were listed on the Nasdaq Composite Index, which had a price-to-earnings ratio of around 90 times in 1999.

Today, it is about 35, with more corrections than during the dot-com era.

Still, the market selloff in recent weeks has been primarily driven by the macroeconomic story, with Trump orchestrating the currency slide.

Traders are taking it slow to account for a number of factors, including growing political unrest in Turkey and indications that the upcoming US tariff round, set to take place on April 2, may be more focused than the expansive, worldwide effort that Trump has previously discussed.

With more than 21 billion shares trading hands on US exchanges - the highest since 2025 - the S&P 500 ended Friday 0.1% higher as a result of the additional volatility brought about by a big expiration of options.

Fears about US trade policy caused the dollar to rise for three days in a row and the yield on 10-year Treasuries to rise slightly.

Following the official arrest of a prominent opposition politician in Turkey, investors are also preparing for further volatility in the country's assets after the rout worsened last week, with Turkish stocks marking their worst performance since after the Lehman collapse in 2008.

In anticipation of greater volatility, the nation's central bank convened a "technical meeting" with commercial lenders on Sunday, while the markets regulator banned short selling of equities.

Cryptos have taken a special liking to the global madness and the penchant for bad news despite a friendly US administration, giving us a sense that much of the price action from Trump's pro-digital assets policies have already been priced in.

This week, traders will closely monitor economic activity data from the US, Europe, and the UK to detect any indications of a slowdown in economic activity due to the uncertainties surrounding tariffs.

Australian inflation data and The US Federal Reserve's favored measure of consumer pricing, Personal Consumption Expenditure data, is coming at the end of the week.

Elsewhere

Blockcast

Chris Yu co-founded SignalPlus in 2021 to address key gaps in the crypto options market, leveraging his experience as a trader and his insights into the market's early-stage potential.

In this Blockcast episode, Yu explains why he sees the state of crypto options resembling the FX options market around 2000 and why there is an opportunity to build infrastructure that could scale with the industry's growth.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Top Crypto Stories This Week: From a Blockhead B.R.O Introduction to a Blockhead Bro Farewell

Blockhead's B.R.O. spreads its wings while a Blockhead bro flies solo...

Nigeria Continues Search for Escaped Binance Exec Nadeem Anjarwalla

Nigeria continues its pursuit of Binance exec Anjarwalla, who fled to Kenya after escaping custody...

Technical Reversal & Tariff Risks: Why We've Adopted Defensive Positioning

Your daily access to the backroom....