Ethereum Whales Pounce On The Dip, Snag $236 Million In ETH

Some crypto traders might see Ethereum’s price decline as a bad sign for their investments and could be pondering if they should offload their holdings.

Meanwhile, whales view the altcoin’s price dip as an opportunity that they must seize by increasing their holdings while the price is down, leading to large investors buying a huge volume of Ethereum in the last three days.

ETH Trading Below $2,000

Analysts said that Ethereum’s price continues to fall as the broader cryptocurrency market is currently experiencing a challenging situation.

Data showed that the world’s largest altcoin struggles to gain an upward momentum and continue to stumble below $2,000.

As of writing, Ethereum is traded at $1,988 per coin, with a market cap of nearly $240 billion.

According to CoinGecko, since ETH hit $3,640 per coin on January 6, the crypto has been steadily decreasing in value with its first major dip happening on January 14, after hitting $3,007.

On February 3, the coin slid further reaching $2,460 and dropped to $2,100 on February 28. Ethereum hit below $2,000 for the first time on March 11. Since then, ETH has been having trouble keeping itself above $2,000.

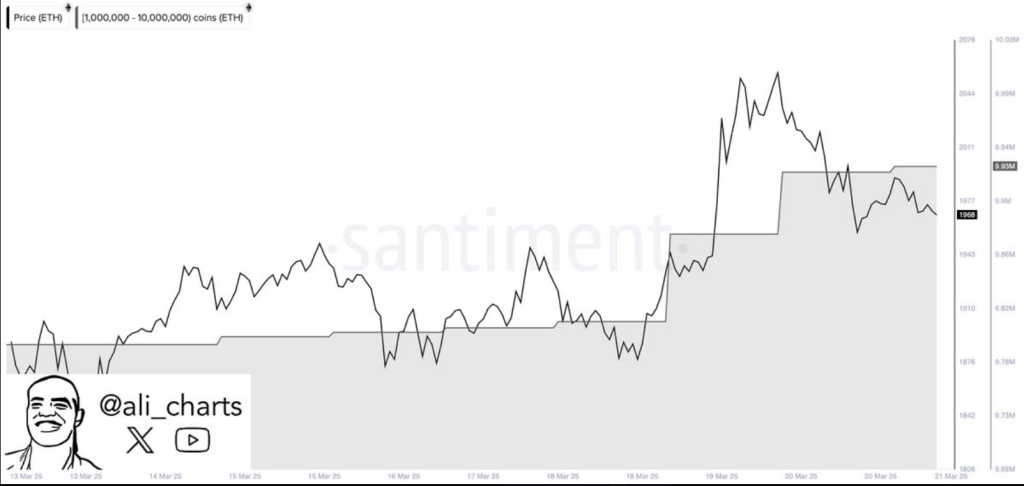

Whales bought over 120,000 #Ethereum $ETH in the last 72 hours! pic.twitter.com/kuZY6u9drS

— Ali (@ali_charts) March 21, 2025

An Opportunity In The Dip?

Ethereum struggling to maintain itself at the $2,000 level might worry many crypto traders, but large-scale investors saw an opportunity in the price dip. Whales used this situation to buy more ETH and further increase their holdings.

Crypto analyst Ali Martinez commented in a post that ETH price decline attracted large investors to increase their buying activity. “Whales bought over 120,000 #Ethereum $ETH in the last 72 hours,” Martinez said.

The analyst presented a chart that showed a spike in the whale ETH accumulation coinciding with the coin’s price decline, adding that Ethereum’s retreat allowed whales to acquire more than 120,000 ETH tokens with a value of about $236 million and they only did that in three days.

“That’s a significant move by the whales! Their accumulation often indicates confidence in the market. It’s fascinating to see how these big players can influence price trajectories,’ Agent Snek commented on Martinez’s post.

Whale Buys Over 7,000 ETH

Whale Buys Over 7,000 ETH

Meanwhile, data analytics platform Lookonchain tracked a whale who added nearly $14 million worth of ETH.

“A whale bought 7,074 $ETH($13.8M) today! The whale withdrew 4,511 $ETH($8.81M) from #OKX 3 hours ago and deposited it into #Aave,” Lookonchain said in a post.

The analyst added that the whale did not stop depositing in Aave, a decentralized finance platform. The large investor borrowed five million USDT from Aave and put it into OKX to purchase an additional 2,563 ETH tokens worth $5 million.

Featured image from Pexels, chart from TradingView

Tron And Bitcoin: Will A Block Reward Cut Boost TRX Price?

TRON founder Justin Sun has revealed that the network might reduce the TRX block rewards due to TRX’...

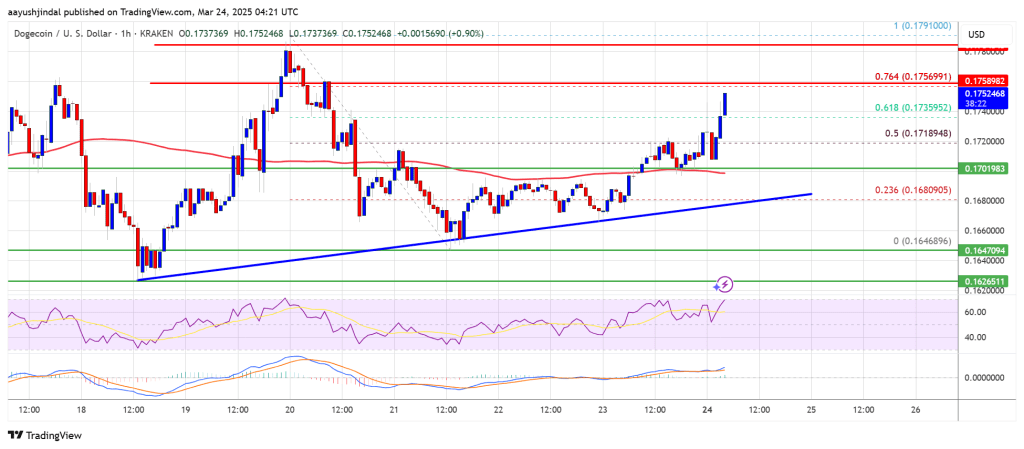

Dogecoin Is ‘Ready For The Next Big Move,’ Warns Analyst

In a fresh market update shared on X, crypto analyst Kevin (@Kev_Capital_TA) presented a weekly DOGE...

Dogecoin (DOGE) Plots Comeback—Is The Meme Coin Gearing Up for a Move?

Dogecoin started a fresh decline below the $0.1720 zone against the US Dollar. DOGE tested $0.1650 a...