Bitcoin Bull Michael Saylor Asks Turkey to “TRY BTC” as Lira Tanks 83% Against USD

Collect

Share

WeChat

Share With Friends Or Circle Of Friends

Renowned Bitcoin evangelist Michael Saylor has subtly urged the government of Turkey to consider adopting a Bitcoin strategy to address the declining national currency.

Saylor made this suggestion in a

tweet

today. He highlighted how the Turkish Lira (TRY) continues its steep decline against the U.S. dollar. The accompanying chart shows the USD/TRY exchange rate reaching 38.00 after the dollar gained 3.73% against the Lira in the past day.

Notably, the chart reveals that the Lira has been on a long-term downtrend against the dollar since at least 2021. According to data from TradingView, TRY has tanked 83% against USD in the last five years. This reflects ongoing economic struggles and inflationary pressures in Turkey.

"TRY Bitcoin"

Meanwhile, MicroStrategy founder Michael Saylor responded to this development with a simple but telling message: “TRY BTC.” His post suggests that Bitcoin could be a viable hedge against failing fiat currencies.

https://twitter.com/saylor/status/1902334001534144926

Saylor has

repeatedly argued

that Bitcoin is a superior store of value for countries like Turkey with high inflation and currency instability. In earlier tweets, he made more direct suggestions regarding Bitcoin for Turkey. According to him, "Bitcoin is hope" for Turkey's inflation struggles.

"If you reside in Turkey, your best wealth preservation strategy is Bitcoin,"

Saylor

said

in the tweet.

BTC as Wealth Preservation

In recent times, Saylor has been more aggressive in his campaign for Bitcoin as a tool for wealth preservation. He emphasized the need for countries to hold it as part of their reserves.

Speaking at the Bitcoin Policy Institute forum, Saylor

outlined

the importance of Bitcoin for the United States' future. He views strategic Bitcoin reserves as a key element in securing the U.S.'s digital supremacy in the 21st century.

Saylor suggested that Bitcoin could generate $10 trillion annually for the U.S. economy if treated as a strategic reserve, similar to real estate that’s rented, developed, or leveraged.

He projects that Bitcoin’s market value could reach $280 trillion in 20 years. In parallel, the U.S. government's $17 billion Bitcoin could be worth anywhere from $3 trillion. Far into the future, he

expects it to be worth $106 trillion

for the United States.

Disclaimer: The copyright of this article belongs to the original author and does not represent MyToken(www.mytokencap.com)Opinions and positions; please contact us if you have questions about content

About MyToken:https://www.mytokencap.com/aboutusLink to this article:https://www.mytokencap.com/news/495026.html

Related Reading

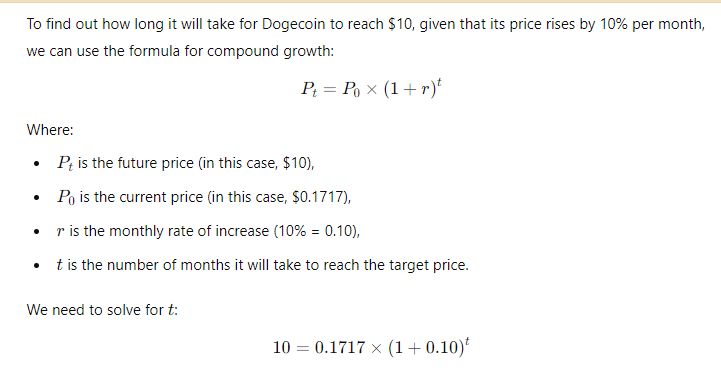

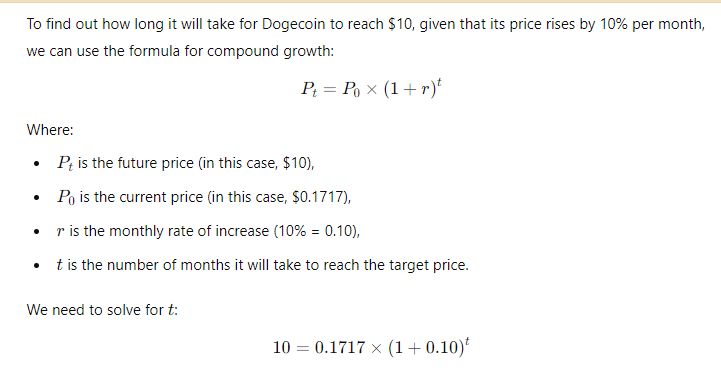

Here’s When Dogecoin Can Reach $10 with a 10% Monthly Growth

Dogecoin could reach the double-digit price range in a few years if it maintains a steady 10% growth...

Europe Must Adopt Digital Euro to Counter Stablecoin Threats and US Payment Dominance, Says ECB Chief Economist

European Central Bank (ECB) Chief Economist Philip Lane has reiterated the need for a digital euro t...

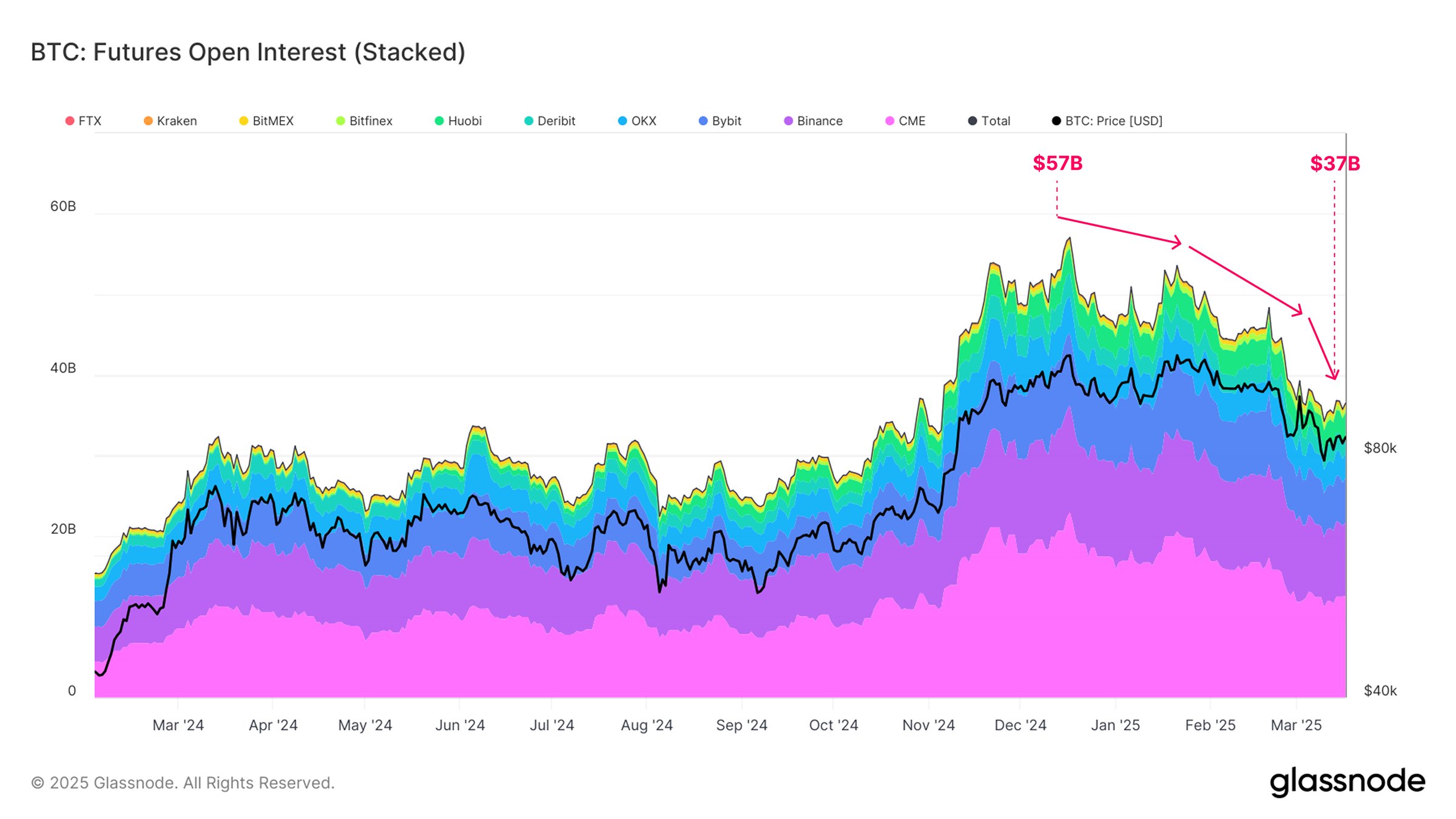

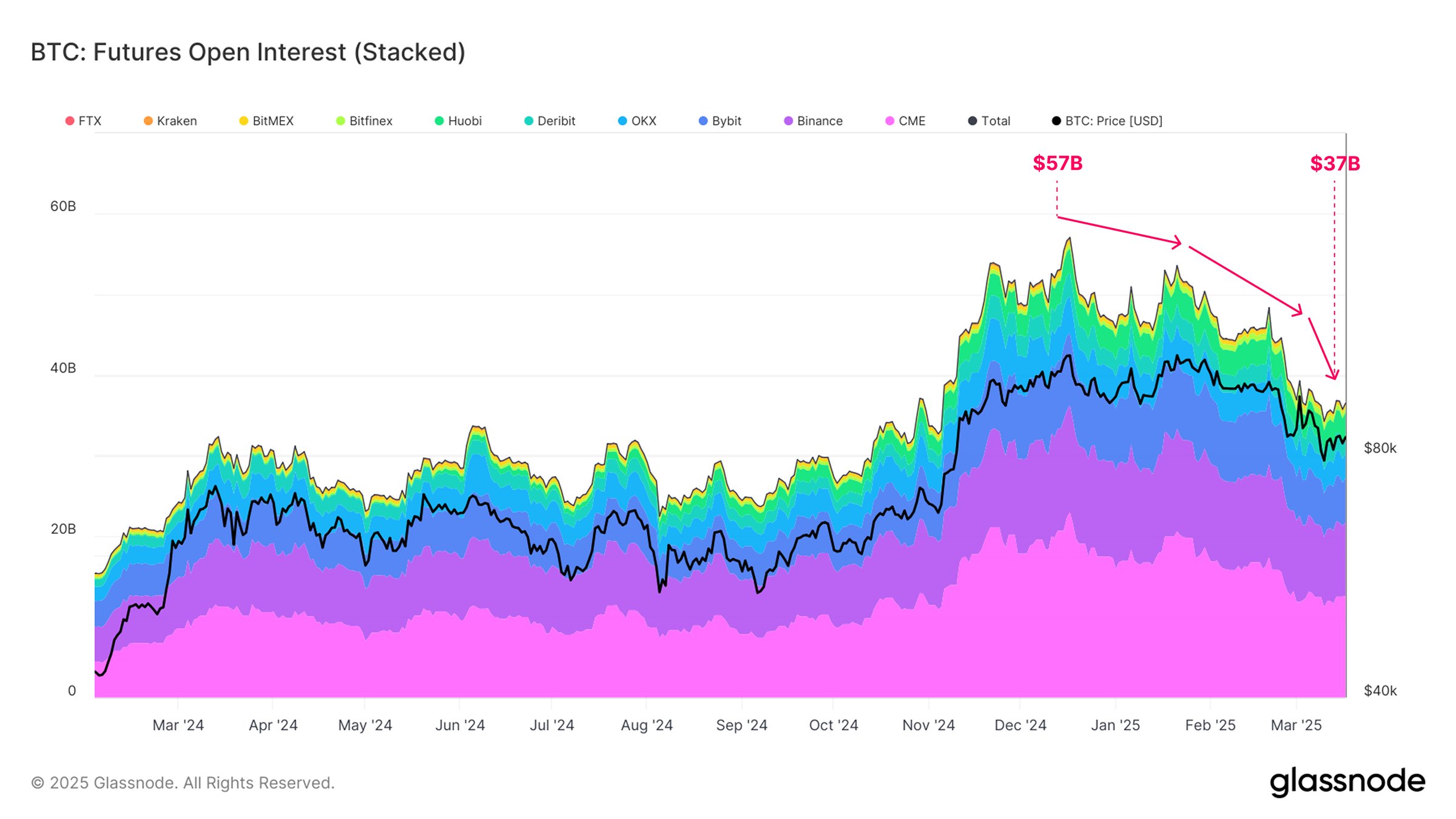

Bitcoin Open Interest Has Dropped 35% to $37B Since ATH: What This Means for Price

Bitcoin Open Interest in the futures market has slumped 35% since the asset's all-time high, as down...