Goldman Sachs Mentions Bitcoin and Crypto for the First Time in Its Annual Shareholder Letter

Collect

Share

WeChat

Share With Friends Or Circle Of Friends

Bitcoin and cryptocurrencies received another high-caliber acknowledgment after Goldman Sachs mentioned the asset class for the first time in its annual letter.

Cryptocurrency appeared in the annual shareholder letter of the second-largest global investment bank for the first time in the firm’s 156-year history. Goldman Sachs mentioned the nascent asset class, highlighting its growing relevance in the financial industry.

The multinational financial services company, based in New York, released its yearly CEO

letter

to investors on March 14 as proxy material for the imminent 2025 Annual Meeting of Shareholders. The letter dissected Goldman Sachs’ fiscal endeavors for the previous year and mentioned Bitcoin for the first time ever.

Cryptocurrency Receives High-Caliber Endorsement

Goldman Sachs highlighted the nascent industry’s growing market influence, driving competitiveness in the financial market. The firm recognized the astronomical demand for distributed ledger technologies like cryptocurrencies, reconstructing the type of products the company and its rivals offered.

Indeed, the crypto industry starred last year following several bullish catalysts. First, the

US spot exchange-traded funds (ETFs)

launched last year, drawing massive liquidity and attention to the market. Then, Donald Trump’s

endorsement

of the sector turned the heat on Wall Street, sparking intense traction toward Bitcoin and altcoins.

Notably, Goldman Sachs stressed that the emergence shifted market sentiments, reshaping the services investments banks offer clients. This impacted its business as some of its clients sought certain products related to crypto that its competitors offered, and it did not.

Moreover, the mention marks a significant step in the digital asset adoption curve. Before now, such remarks were unforeseen due to the investor sentiments around the sector.

Nonetheless, the prominent investment bank warned users of the uncertainties associated with cryptocurrency ventures. While acknowledging its increasing relevance, Goldman Sachs stated that its nascent nature leaves room for intense vulnerability from cyber-attacks and “other inherent weaknesses.”

Goldman Sachs’ Long History with Crypto

The financial services firm has had a long history with the crypto industry, launching a crypto desk as early as 2021. A year later, it debuted the Goldman Sachs Digital Asset Platform (GS DAP) to facilitate the issuing and custody of digital assets such as digital bonds.

Since then, the bank has made

significant efforts

to offer Bitcoin to its clients. In February, Goldman Sachs

revealed

holding $1.27 billion in Bitcoin through the BlackRock iShares Bitcoin Trust (IBIT) and over $470 million in the Ethereum spot ETFs.

Meanwhile, sentiments about crypto have generally been bullish for Goldman Sachs. Its CEO, David Solomon,

described

Bitcoin as a store of value despite its highly speculative nature.

Disclaimer: The copyright of this article belongs to the original author and does not represent MyToken(www.mytokencap.com)Opinions and positions; please contact us if you have questions about content

About MyToken:https://www.mytokencap.com/aboutusLink to this article:https://www.mytokencap.com/news/494128.html

Previous:WebKey勇夺BNB Chain流动性赛首日冠军

Related Reading

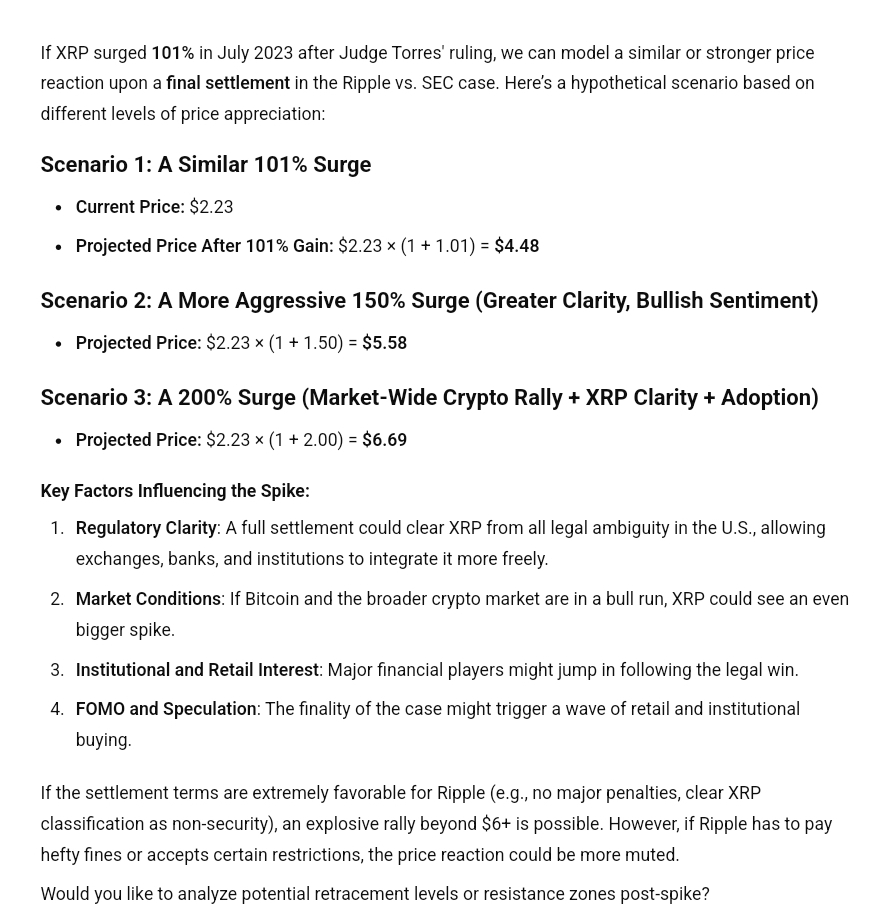

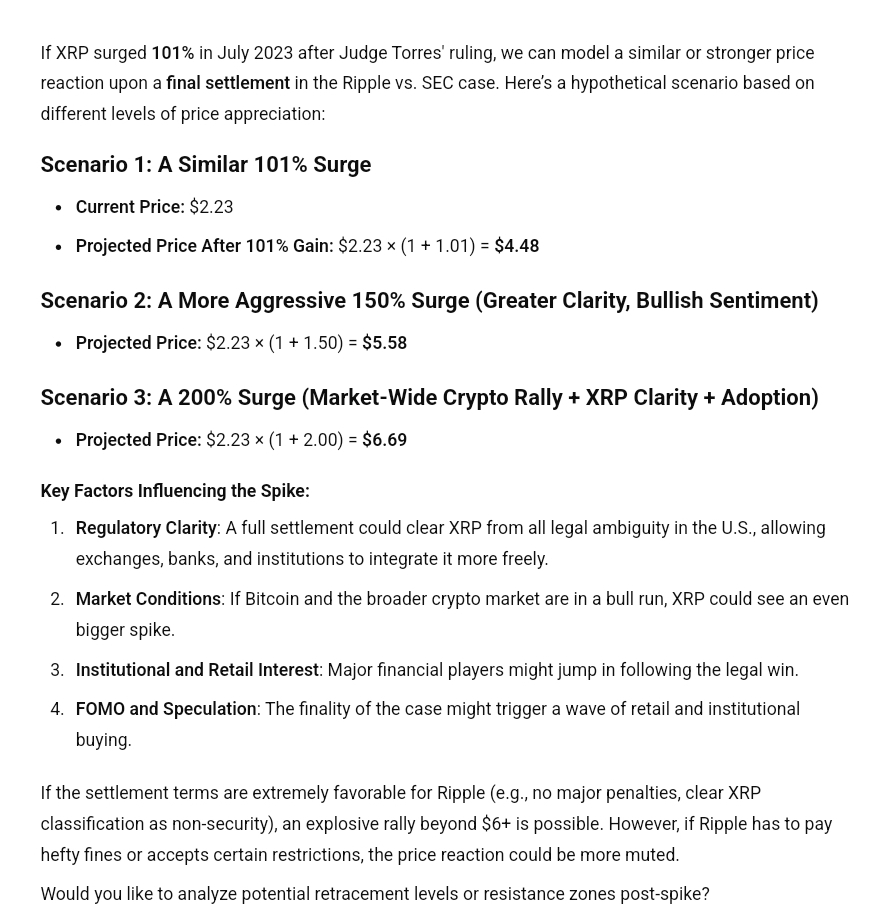

Expert Says Holding Just 1,000 XRP Could Be the Best Financial Decision of Your Lifetime

XRP community figure Edo Farina recently suggested that holding a few XRP tokens could lead to finan...

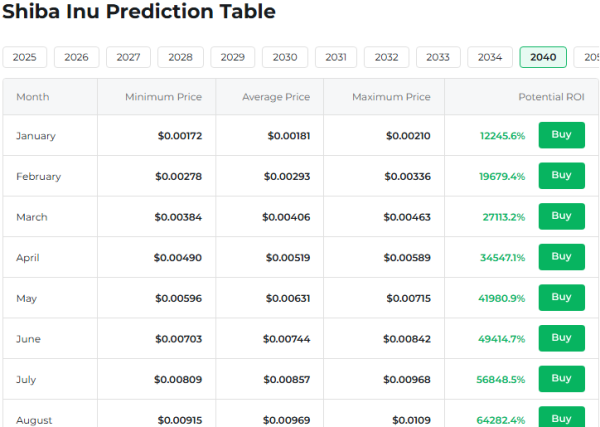

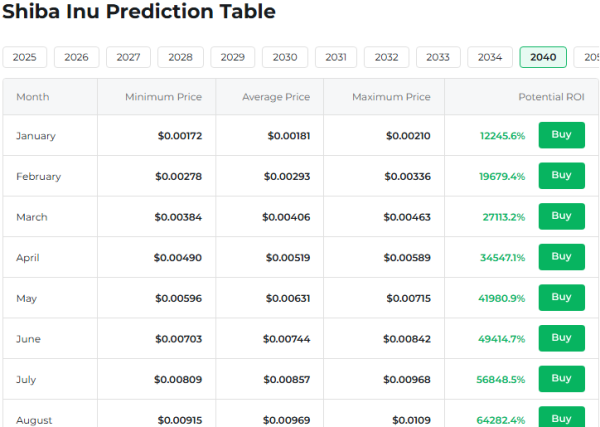

Shiba Inu Team Says a SHIB Surge to $0.01 Is Possible but Not Imminent

The marketing lead of the Shiba Inu ecosystem expresses confidence in SHIB’s long-term potential, fo...

Here’s How High XRP Could Rise if SEC Drops Ripple Lawsuit Per Latest Credible Rumors

XRP could rise by substantial margins if it reacts favorably to the upcoming settlement between the ...