Bitcoin Price Analysis: How Weak Demand is Fueling a Prolonged Downturn

The post Bitcoin Price Analysis: How Weak Demand is Fueling a Prolonged Downturn appeared first on Coinpedia Fintech News

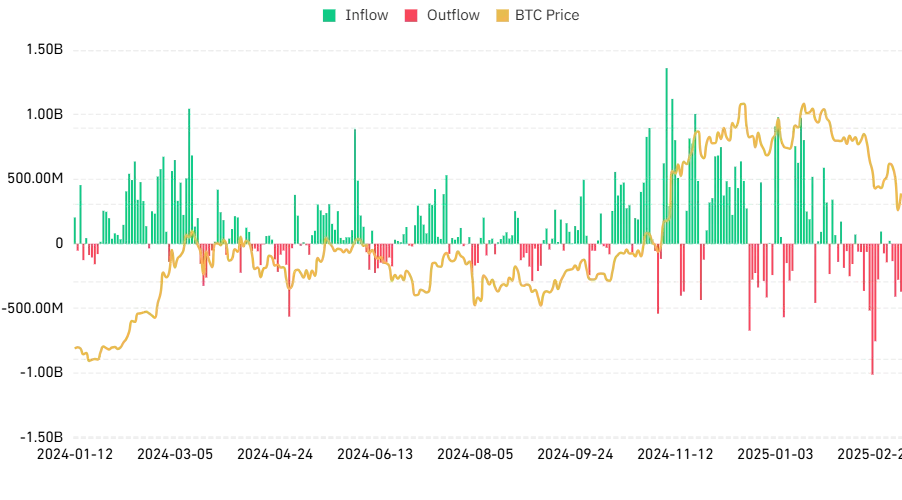

Bitcoin is showing strong bearish signals as key valuation metrics indicate weakness. Demand is contracting, whales are slowing accumulation, and spot Bitcoin ETFs have turned into net sellers. Currently, the BTC price stands at $82,706 – at least 32.39% below the all-time high. In the last 30 days, the Bitcoin market has experienced a drop of 15.3%. In the last seven days alone, the market has dropped by 5.8%. The question remains: Is this normal, or the start of a deeper downturn?

Bitcoin Metrics Turn Bearish

The CryptoQuant Bitcoin Bull-Bear Market Cycle indicator is at its most bearish level in this cycle. Importantly, the MVRV Ration z-score has declined below its 365-day moving average . What this suggests is a loss of upward momentum.

Bitcoin Demand Is Weakening

According to the CryptoQuant weekly report, whales have slowed their accumulation. Bitcoin ETFs in the US are now net sellers instead of buyers.

Yesterday alone, at least 371M flew out of the Bitcoin Spot ETF market. At least 35.50M flew out of GBTC, around 151.3M from IBIT, nearly 107.10M from FBTC, 9.10M from BITB, 14.9M from BTCO, 600K from HODL, and around 3.4M from BRRR.

Bitcoin’s apparent demand shrank by 103K last week, the fastest decline since July 2024.

At the start of March, the price of BTC was at $84,352.73. On the second day, it climbed to a peak of $94,302.78. This month, the market has suffered at least two serious corrections: a 8.55% correction on March 3 and a 13.27% correction between March 6 and 10. Yesterday, the BTC market grew from $78,629 to 82,922. Currently, the price stands at $82,706 – slightly below yesterday’s closing price.

As per the report, the annual accumulation rate of investors has also dropped significantly.

How Deep Will This Correction Go?

Right now, the price of Bitcoin is at least 32.39% below its all-time high. The BTC markert has witnessed a sharp correction.

Valuation metrics suggest this correction is deeper than those seen in previous bull runs.

If demand remains weak, Bitcoin could enter a prolonged bearish phase.

In conclusion, Bitcoin is facing serious bearish pressure, with shrinking demand and negative signals from key metrics. While similar corrections have happened before, the depth of this downturn raises concerns about whether BTC is headed for a prolonged bear market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046 this year if the bullish sentiment sustains.

With increased adoption, the price of 1 Bitcoin could reach a height of $610,646 in 2030.

As per our latest BTC price analysis, the Bitcoin could reach a maximum price of $5,148,828.

By 2050, a single BTC price could go as high as $12,436,545.

MGX Makes Historic $2 Billion Investment in Binance, Marks Largest Single Investment in Crypto

The post MGX Makes Historic $2 Billion Investment in Binance, Marks Largest Single Investment in Cry...

Russia’s Central Bank Plans Limited Crypto Trading for Select Investors

The post Russia’s Central Bank Plans Limited Crypto Trading for Select Investors appeared first on C...

Bitcoin’s 4-Year Growth Rate Hits Record Low – What It Means for Investors

The post Bitcoin’s 4-Year Growth Rate Hits Record Low – What It Means for Investors appeared first o...