Solana Revenue Has Crashed 90% Since January

With the markets turning into a bloodbath, last year's unstoppable cryptocurrency, powered by memecoins, is now suffering its own bloodshed.

According to reports , Solana's chain revenue is down over 90% from its January highs, returning to levels not seen since September 2024. Earning an average of just $4 million per week over the last fortnight, its revenue has paled in comparison to its $38.5 million per week in mid January.

However, despite these setbacks, Solana’s current revenue remains higher than in late summer 2024. Back then, weekly earnings dipped below $2 million between August and September.

The sharp drop in revenue stems from a significant decrease in transaction fees accrued on the network. Currently, Solana is generating around $8 million in fees per week, marking the lowest weekly fee period since September.

Total Value Locked (TVL) on Solana has also shrunk by nearly 50%, from over $12 billion in January to around $6.4 billion today.

This decline has been exacerbated by the collapse of several high-profile memecoins , including TRUMP, LIBRA, MELANIA, and ENRON. Memecoin trading, which largely took place on the Pump.fun platform, accounted for roughly 80% of Solana’s revenues at its peak.

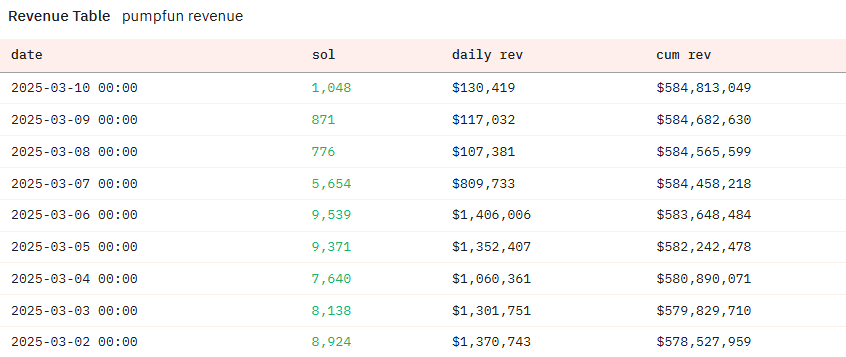

Pump.fun’s daily revenue has fallen 95%, from a high of $15 million in late January to as low as $107,000 this month.

After reaching a peak market capitalization of $137 billion in December, the memecoin sector has lost 68% of its value, now standing at $44 billion.

Broader market conditions have also played a role in the downturn. Bitcoin has fallen nearly 30% from its all-time high of $109,000, dipping below $80,000.

Solana's token, SOL, has also taken a significant hit. Since reaching an all-time high of $295 on January 19, SOL has tumbled 60%, now sitting at around $120.

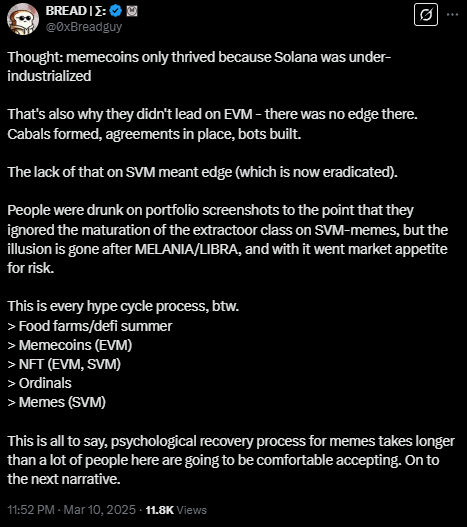

0xBreadGuy, a contributor to MegaEth, explained that traders were caught up in the excitement of portfolio gains but overlooked the increasing sophistication of market manipulators in the Solana Virtual Machine (SVM) ecosystem.

"People were drunk on portfolio screenshots to the point that they ignored the maturation of the extractoor class on SVM-memes, but the illusion is gone after MELANIA/LIBRA, and with it went market appetite for risk," he noted .

OKX Slams "Misleading" Bloomberg Article Tying it to Bybit Hack Investigation

OKX denies EU probe over ByBit hack, calling claims misleading. It froze hacked funds, blamed ByBit'...

SEC Delays XRP, SOL, LTC, ADA, DOGE ETFs But Franklin Templeton Files for XRP ETF Anyway

SEC delays decisions on multiple crypto spot ETFs to May 2025; Franklin Templeton files for XRP ETF ...

Trump Bump Fast Turning Into Slump Dump on Recession Bets

Trump's market boost fades as recession fears grow, turning the "Trump bump" into a "slump dump"...