Crypto

Mirror Protocol

MIR

Mirror Protocol

#--

$0.03522

-7.62%

≈$0.01243

BNB Chain

DeFi

Terra Ecosystem

Trading Volume / 24H%

$60,517.13

-7.62%

24H Turnover Rate

3.12%

Market Cap

$1.94M

FDV

$4.61M

Circulating Supply

156.06M MIR

Circulation Ratio

42.1%

24 Hours

-7.62%

7D

22.68%

3 Months

67.48%

6 Months

-54%

1 Year

-47%

All

- -

Underlying Chain

GoPlus

Ethereum,BSC

Core Algorithm

Consensus Mechanism

Project Launch Date

Initial Issuance Method

Official Website

Whitepaper

Social Media

Social Media

Blockchain Explorer

Blockchain Explorer

Market Cap

$1,940,348.00

Market Cap Ratio

<0.01%

FDV

$4,607,627.61

Circulating Supply

156,055,246 MIR

Total Supply

370,575,000 MIR

Circulation Ratio

42.1%

Maximum Supply

370,575,000 MIR

Trading Start Date

2020-12-04

Number of Listed Exchanges

9

Initial Price

$1.3622

Project Information

View More

MIR is a governance token for Mirror Protocol, a synthetic asset Protocol built by Terraform Labs (TFL) on the Terra blockchain. Mirror Protocol is a decentralized Protocol where on-chain vaults and code changes are governed by the holders of MIR tokens. TFL has no intention of retaining and selling MIR tokens, nor has it granted administrative keys and special access rights. The aim is to be a fully decentralized, community-driven project.

| TokEcon | Quantity | Percentage |

|---|---|---|

mAsset LP Staking | 167.5M | 45.2% |

community pool | 167.5M | 45.2% |

MIR LP Mortgage | 38.54M | 10.4% |

airdrop | 18.16M | 4.9% |

LUNA Staking Rewards | 18.16M | 4.9% |

Unlock Event

SUL

| Date | Unlocked | MCR | Details |

|---|

Related Information

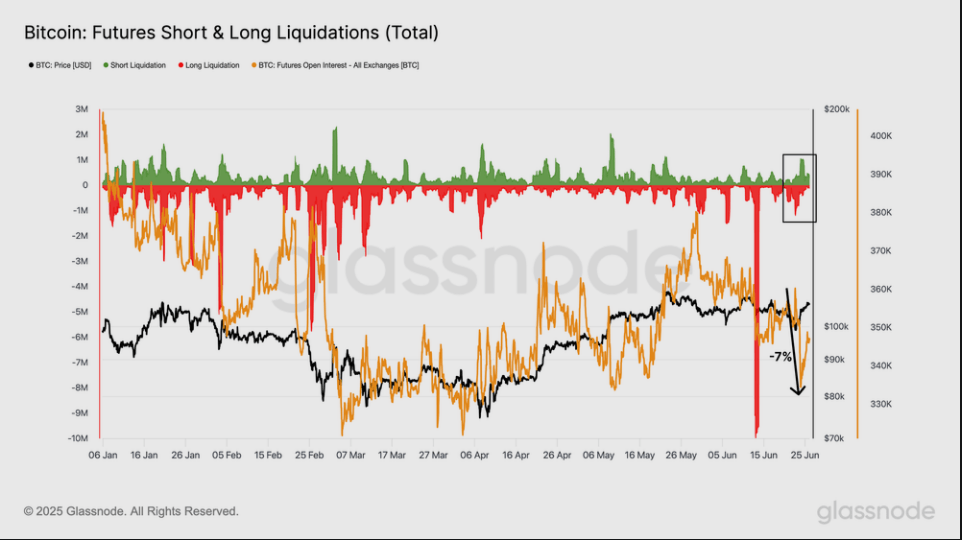

The $100K Mirage: Bitcoin’s Rally Not Backed By On-Chain Strength

NewsBTC

2025.06.28 12:30

Trump Admires GENIUS Act: A Bold Move for U.S. Crypto Leadership

blockchainreporter

2025.06.19 09:00