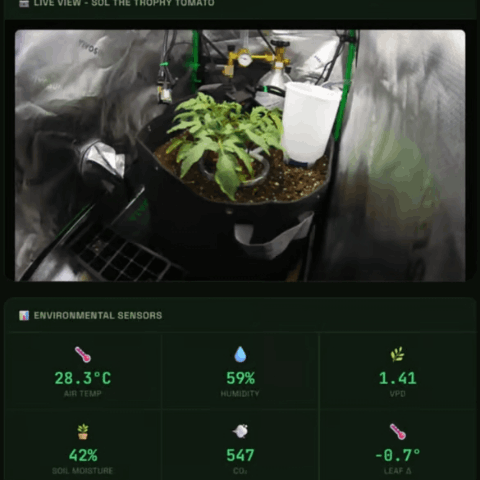

Holdings

74.79B+0.66%

24H Liquidation

569.19M-63.61%

BTC ETF 7D net inflow

-1.92万 BTC

ETH ETF 7D net inflow

-22.16万 ETH

Crypto Index

Crypto Index

$2.33T

BTC

ETH

Others

ETF Y-Flow >

5,260.21 BTC

≈330.7M USD

Fear & Greed Index

6

Extreme Fear

Market Share

58.44%

-3.56%

10.42%

-2.14%

Notification | Short-Term Trading Assistant Performed Selling BTC/USDT

MyToken Short-Term Trading Assistant just detected a sell signal of BTC/USDT at UTC/GMT 11:00:00 am, Feb. 07, with the sell price at 67987.00 USDT.

According to the analytical result from Short-Term Assistant, recently BTC is going weak and showing a downtrend.

The next resistance level above is 71245.11 USDT.

To learn about more trading signals, please go to「MyToken - Assistants - Trading Assistants」💡

Bitcoin rose one place in global asset market capitalization rankings, but its social sentiment index hit a near four-year low.

According to Odaily Planet Daily, data from 8MarketCap shows that Bitcoin has risen slightly by one place in the global asset market capitalization rankings, now ranking fourteenth with a current market capitalization of $1.36 trillion, a 24-hour increase of 3.29%. Furthermore, according to a post on the X platform by crypto analyst Ali citing Santiment data, the Bitcoin social sentiment index has reached a nearly four-year low, indicating that retail investor panic has peaked. Technically, Bitcoin is approaching its 200-week moving average (currently at $58,000), a level that has repeatedly served as a bottom and accumulation zone in bear markets over the past 12 years.

Caixin: Equity-based and asset-backed securities-based RWAs are regulated by the China Securities Regulatory Commission (CSRC), while foreign debt-based RWAs are regulated by the National Development and Reform Commission (NDRC).

Huoxun Finance reported on February 7th that, according to Caixin.com, the issuance of Real-World Asset Tokens (RWAs) overseas by Chinese assets will no longer be a gray area. The China Securities Regulatory Commission (CSRC) has issued the "Regulatory Guidelines on the Issuance of Asset-Backed Securities Tokens Overseas by Domestic Assets," which for the first time explicitly defines RWAs and provides a clear regulatory framework. The regulatory authorities believe that equity-based RWAs, asset-backed securities-based RWAs, and foreign debt-based RWAs should be regulated according to the principle of "same business, same risk, same rules," referring to the same legal and regulatory oversight as their corresponding traditional financing businesses. Therefore, equity-based RWAs and asset-backed securities-based RWAs are regulated by the CSRC; foreign debt-based RWAs are regulated by the National Development and Reform Commission (NDRC). Similar to traditional overseas financing businesses, overseas RWAs also involve the repatriation of funds raised overseas, which is regulated by the State Administration of Foreign Exchange (SAFE). Other forms of RWAs are regulated by the CSRC in conjunction with relevant departments according to their respective responsibilities.

Trend Research has essentially completed its liquidation, with a final loss of approximately $734 million on ETH.

According to Huoxun Finance on February 7th, based on monitoring by on-chain analyst Yu Jin, with Trend Research essentially completing its liquidation, their final loss on ETH is now clear: approximately $734 million. Including their previous long positions on ETH, the combined loss from these two ETH trades is $419 million: 1. Entering at an average price of $2,667 to long 231,000 ETH, and liquidating at an average price of $4,027, resulting in a profit of $315 million; 2. Entering at an average price of $3,180 to long 651,500 ETH, and liquidating at an average price of $2,053, resulting in a loss of $734 million. However, according to some reports, although Trend Research suffered a huge loss on ETH, the fund as a whole did not lose money; only previous profits were largely wiped out. Their profits in other cryptocurrencies offset the ETH loss; for example, they made money on WLFI and FORM.

Two whales have accumulated over 29,000 ETH in the past 13 hours.

According to Lookonchain monitoring, two whales accumulated over 29,000 ETH in the past half day. Specifically, 0x46DB withdrew 19,503 ETH (worth $40 million) from OKX in the past 13 hours, and 0x28eF withdrew 9,576 ETH (worth $19.78 million) from Binance in the past 8 hours.

Top Funding Rate

PF_DFUSD | 1.1104%4h |

PF_MOGUSD | 1.0428%4h |

PF_CATUSD | 1.0332%4h |

PI_LTCUSD | 1.0319%4h |

PF_MIRAUSD | 1.0064%4h |

Long/Short Ratio

BTC | 1.10 | |

ETH | 0.74 | |

SOL | 0.24 | |

XRP | 1.02 | |

DOGE | 0.50 |

Global Index

US Dollar Index (DXY)

$97.63

-0.19%

London Gold (XAU)

$4,961.15

3.99%

S&P 500 Index (SPX)

$6,932.3

1.97%

Nasdaq Index (IXIC)

$23,031.21

2.18%

ChainData

Spot

Derivatives

Unlock

Sector

$1.14M

$1.14M

$2.39M

$2.39M

$2.46M

$2.46M

$2.29M

$2.29M