Top 5 Best Cryptos to Buy Now and Hold Until 2026

Donald Trump’s proposed tariff dividend could give the US economy the same jolt that stimulus checks did back in 2020.

Combine that with cheaper dollars after the October 29 rate cut and a possible resolution to the US government shutdown, and investors are suddenly hungry for risk again. Crypto, naturally, is front of mind.

To benefit from this bullish movement properly, your portfolio needs to mix blue-chip bets like Bitcoin, Ethereum, and Solana with high-upside opportunities.

And nothing says 100x like DeepSnitch AI , a presale project building the Bloomberg Terminal for crypto traders. It’s the perfect time to stack conviction coins before the next bull run. Here’s a breakdown of the top 5 best cryptos to buy now and hold through 2026.

Top 5 next crypto to 100x in 2026

DeepSnitch AI: The best crypto to buy now

DeepSnitch AI is a meme coin project developing a product that the 100M+ crypto traders would actually want to use. The team is now building one of the most powerful AI information tools in crypto, powered by five smart agents scanning raw data nonstop.

These agents are designed to spot the best low-risk, high-reward investments and send them directly to your Telegram, where most crypto traders already live.

And with the November rally heating up after the FED cut rates on October 29, timing couldn’t be better. Risk appetite is back, and analysts expect crypto to benefit first, especially the AI sector.

With AI spending set to hit $1.5 trillion in 2025, and DeepSnitch targeting Telegram’s massive 1 billion user base, this could be one of the best cryptos to buy now.

While the snitches are still rolling out, the protocol launched its staking platform so early investors can earn while they wait. Over 12 million tokens have already been staked by November 12, a clear sign that the market sees the potential.

DeepSnitch AI has now raised over $520K, with the token price jumping 50% to $0.02244. It’s giving early Dogecoin vibes, but with a product that will make the surge much more sustainable in the long term.

Analysts believe XRP could reach $8.3 in the next year

XRP was trading around $2.43 on November 11, just off its $2.55 high. Bulls are still in control as attention is shifting to the recent launch of the first US spot XRP ETF.

Analysts are eyeing bold targets ranging from $8.30 to $14 if the rally holds. One major reason is the 3-month Ichimoku Cloud chart. For the first time ever, XRP has stayed above both baseline and conversion lines for nearly a year.

The ETF debut adds fuel. Canary Funds’ XRPC fund hits Nasdaq on November 12, with all approvals locked in. The move could bring new institutional flows and push XRP deeper into the mainstream.

Ripple’s aggressive 2025 strategy is making XRP a stronger candidate for the best crypto to buy now. The company has spent $4 billion on deals this year, buying Hidden Road for $1.3B and GTreasury for $1B. It launched a US OTC desk, raised $500M, and now holds a $40B valuation.

Solana registers 10-day ETF inflow streak

Solana was holding around $167 on November 11, showing strength near the $150-$160 zone, which is a level that acted as a launchpad in past cycles.

On higher timeframes, SOL looks like it may have found a local bottom. Volume around $150 suggests quiet accumulation, likely from long-term holders.

Altcoin Sherpa says if Bitcoin holds steady, Solana could be building a base for recovery. The chart is forming a higher low, with price now testing resistance between $175 and $180.

The real test is $185. That’s the midpoint of Solana’s long consolidation range from $120 to $260. A clean reclaim could flip the trend and send the price back toward $250-$260.

Big money is paying attention. Solana ETFs have now seen 10 straight days of inflows, signalling confidence from institutions. Developer activity is still high, and network upgrades continue. If momentum keeps building and the market stays risk-on, Solana could be gearing up for its next breakout.

Avalanche is looking at $40 if the fundamentals remain strong

Avalanche was trading just under $19 on November 11, recently breaking out of its long-term downtrend. If this momentum keeps building, a move toward $22-$25 may not be far off.

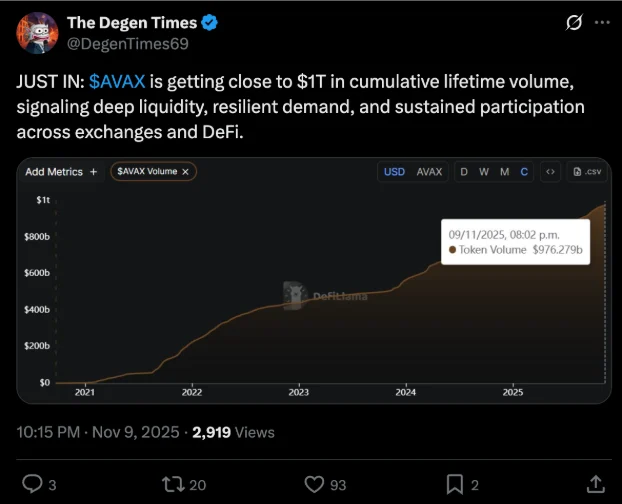

Activity on the network is rising fast. AVAX is close to hitting $1 trillion in cumulative trading volume, a sign of deep liquidity and renewed interest from traders across DeFi and centralised exchanges. This shows confidence is coming back for the layer 1 blockchain, with many investors believing AVAX is the best crypto to buy now.

Price action supports it. The token has reclaimed key levels, and $17-$18 remains a strong demand zone. This area triggered past rallies, and the current chart looks similar. If volume picks up, bulls could push toward $25, with some analysts even calling for $40-$50 over the next few months.

Ethereum needs to flip $3.7K to continue its bullish rally

Ethereum was holding steady above $3,500 on November 11 after dipping to $3,400 earlier this month. Price action has slowed, but the bigger trend is still intact. Many traders see this as normal consolidation, not a reversal. As long as ETH stays above $3,000 and reclaims $3,700, bulls remain in control.

Right now, ETH is stuck in a narrow range, but analysts like Crypto Caesar say the structure still supports a longer-term move up. A retest of $3,000 would only confirm strength if buyers step in again. If momentum returns, Ethereum could aim for $4,300, but it first needs to flip $3,700.

A verified whale just bought 75,000 ETH, worth $269 million, taking total holdings near $950 million. ETF inflows are steady, and on-chain data shows $1.37 billion in ETH scooped up during recent dips.

Staking is rising too. Almost 32% of the ETH supply is now locked, and that reduces the liquid supply. If Bitcoin leads the way, ETH could follow fast, but it all hinges on a clean break above $3,700. Until then, it’s a waiting game with bullish pressure building underneath.

Closing thoughts

All five tokens look strong heading into 2026, but if you’re aiming for the best high-reward opportunity, DeepSnitch AI might be the best crypto to buy now.

While heavyweights like Solana and Avalanche are already largely priced in, DeepSnitch is still early, and that’s where the real upside lies.

At just $0.02244, DSNT is positioned at the crossroads of two booming sectors: AI and crypto. As the AI market continues to expand, DeepSnitch’s value could scale exponentially.

If it captures even a small slice of Solana’s long-term market cap, the token could easily be the next crypto to 100x.

Visit the official DeepSnitch AI website , join the Telegram , and follow on X (Twitter) for the latest updates.

FAQs

What are the top cryptocurrencies to buy today with long-term upside?

While Ethereum and Solana remain top cryptocurrencies to buy today, DeepSnitch AI stands out for early-stage growth potential. Its AI-powered trading tools and presale price of just $0.02244 make it one of the best cryptos to buy now and hold.

Which trending coins this week are worth watching?

Among the trending coins this week, DeepSnitch AI is attracting the attention of whales thanks to over $520K raised and 12M tokens staked. Investors are turning to utility-backed meme coins like DSNT that combine virality with practical AI tools for traders inside Telegram.

Is DeepSnitch AI a better option than other top cryptocurrencies to buy today?

Yes. DeepSnitch AI is still in its early stages, offering massive upside compared to established tokens. Its AI snitches give it real value, making it one of the top cryptocurrencies to buy today for those seeking 100x potential.

Why is DeepSnitch AI one of the most trending coins this week?

With the FED cutting rates and investor appetite returning, DeepSnitch AI’s AI-driven tools and staking utility have pushed it to the top of trending coins this week.

This article is not intended as financial advice. Educational purposes only.

How Milk Mocha’s $HUGS, DeepSnitch AI, Pepenode, & Bitcoin Hyper Could Shape the Next Big Altcoin Era Before 2026

Discover how Milk Mocha ($HUGS), DeepSnitch AI, Pepenode, and Bitcoin Hyper are shaping Q4’s next bi...

Forget ETH’s Strong Market Energy & DOGE’s Q4 Slowdown: BlockDAG’s 50B Cap is Running Out with Only 4.3B BDAG Remaining

Explore how BlockDAG’s fixed 50B supply sparks long-term value potential as Ethereum strengthens its...

Top Liquid Staking Projects to Watch: EigenCloud, Lido, Babylon, Jito, Pendle, and Others Lead in Development Activity, Showing Their Popularity

The report highlighted crypto protocols that are reinforcing their positions as the most actively de...