BNB Rebound Underway? Price Caught Within A Head And Shoulders Pattern

BNB ’s price is showing signs of a rebound but remains trapped within a head and shoulders pattern. This setup could decide whether the token continues higher or faces another pullback in the coming sessions.

Head and Shoulders Pattern Signals Possible Downside Move

Crypto analyst Batman highlighted in a recent update on X that BNB is currently forming a Head and Shoulders (H&S) pattern on the lower timeframe chart. This classic top formation is a significant bearish signal, strongly indicating that the immediate upward momentum is failing and a structural reversal may be imminent as sellers gain control of the asset.

Supporting this bearish outlook, Batman identifies an unfilled Fair Value Gap (FVG) situated just below the current price action. In market mechanics, an FVG acts like a “price magnet,” representing an inefficiency that the market is highly likely to return to and fill. This powerful confluence of the H&S pattern and the unfilled FVG makes a deeper move lower in the very near future extremely probable.

Crucially, Batman views this predicted move down not as a market failure, but rather as a necessary retracement that finalizes the setup for a high-value entry. If the market delivers this anticipated pullback , it will create a perfect confluence for a long position, turning the immediate bearish scenario into a strategic opportunity.

This expected retracement is structurally significant because the target lines up perfectly with two critical support metrics: a key Fibonacci level and a major Order Block (OB) zone, which proves solid for initiating a long position.

BNB Finds Relief After Prolonged Downtrend

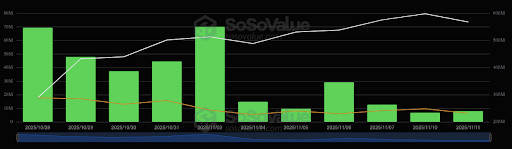

In a more recent post , BitGuru shared an insightful analysis of BNB’s ongoing market behavior, highlighting a significant shift in its price structure. According to Bitguru, the cryptocurrency has likely formed a major low around the $864 level after enduring a strong downtrend followed by an extended consolidation period. This region appears to have acted as a crucial accumulation zone where selling pressure weakened and buyers started to show renewed confidence.

BitGuru observed that BNB is currently showing stability near the $950 level, suggesting that the market may be entering a phase of gradual recovery and that buyers are slowly regaining control. This stabilization is often an early signal that sentiment is turning bullish , especially as volume begins to build in favor of the buyers.

Looking ahead, BitGuru believes that if the $950 support holds, there’s room for a potential rebound toward the $1,050–$1,100 range. A sustained move in this direction would likely confirm growing market strength and could even mark the beginning of a medium-term uptrend.

Abundance of Catalysts Suggests XRP Price Could Take Off This Week

XRP is entering one of its most crucial weeks in months as a series of bullish catalysts align to se...

Ripple Exec Reveals Why The Bitcoin Price Is So High Now

Ripple’s Chief Technology Officer (CTO), David Schwartz, has provided a clear explanation for why th...

Institutions Have Been Buying Solana Every Day For 2 Weeks, Is $300 Possible?

Institutional capital is circling back to Solana (SOL) as Spot Exchange Traded Funds (ETFs) open the...